COVID-19 and uncertainty almost go hand-in-hand. From the earliest days of news coverage and throughout the pandemic’s development, information about the novel virus has changed frequently.

As the health crisis progressed, the novelty of the situation—and the challenges that come with it—became even clearer. Many businesses closed or went remote, supply chains worldwide were impacted, and the state of the global economy quickly became just as unpredictable as the virus itself.

“Finance chiefs are tearing up earnings forecasts, slashing dividends and padding their moats with available cash,” opened one article on the topic.

Clearly, survival instinct kicked in.

CFOs Making sense of the financial COVID chaos

There’s no question, the coronavirus pandemic presents unique and severe challenges for CFOs and other financial leaders. But as businesses rush to digitally transform and meet the demands of the COVID-era market, it’s important to think critically about what gets prioritized.

In this post, we’ll explore top concerns, the reasons behind them, and what CFOs who share them should consider as they plan for the future.

This is important information for CFOs entertaining cost-cutting ideas such as reducing office real estate and embracing remote work for the long term.

A clearer picture of the costs incurred by productivity differences and the price of increasing IT support, connections, and hardware for employees working from home should be balanced against any savings a divestment would provide.

Concern #1: Balance sheets and cash flow

CFOs know that, in times of crisis, increasing liquidity to battle cash flow challenges is typically the first priority. Businesses need cash on hand and the ability to move money to where it’s needed most as situations rapidly evolve.

COVID-19, as a crisis, isn’t any different. Over 170 U.S. businesses have blamed COVID-19 for their bankruptcy, including big brands like Hertz and J.C. Penney. As consumer confidence slipped due to widespread economic uncertainty and customers delayed their payments, cash reserves dipped in tandem.

“[W]ith some companies losing up to 75 percent of their revenues in a single quarter, cash isn’t just king—it’s now critical for survival,” McKinsey reports.

The article goes on to recommend scenario planning, increased communication, and re-evaluating investments to strengthen the balance sheet. It also notes that resilient companies divest assets 1.5 times more than their peers.

Back in March 2020 as the business world began to feel the effects of the pandemic, Jason Burke, founder and CEO of Positive Venture Group (PVG)—a leading outsourced finance services company—suggested CEOs ask themselves some important questions:

- What does my hiring plan look like right now?

- What investments am I making in the next year?

- What should I be doing to make sure that I don’t lose ground?

Answers to these questions would help business leaders continue driving success by determining their non-critical expenses and working toward extending their runways as far as possible.

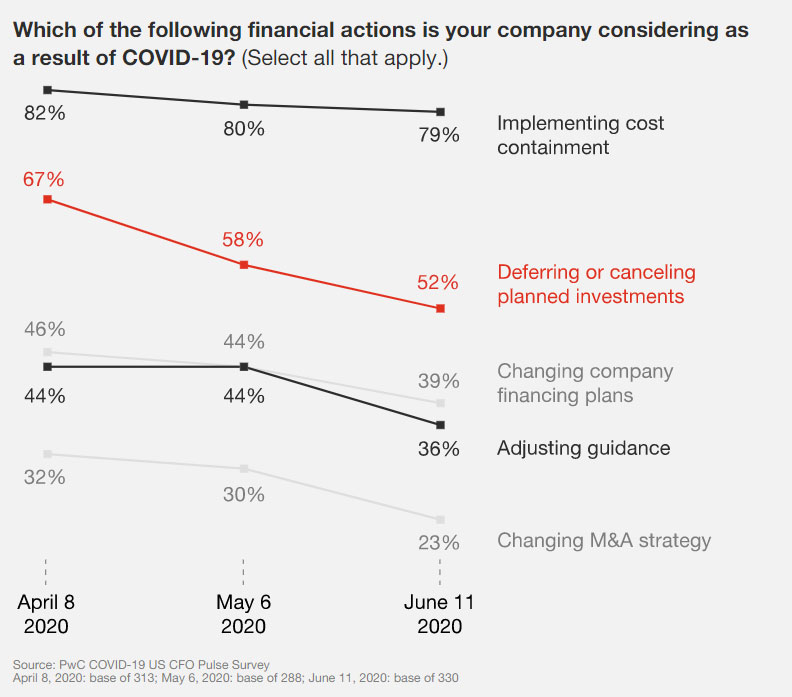

Then as the months wore on, deferring or cancelling planned investments began trending downward as a CFO tactic, according to a PwC survey of CFOs.

Clearly, beyond the immediate liquidity response lie trickier waters to navigate. What investments and divestments should CFOs prioritize or deprioritize? Should they consider mergers and acquisitions?

The answers to these questions will vary based on the business. As most witnessed during COVID-19 lockdowns, many retail stores laid off or furloughed employees while grocery stores invested in hiring more. The decision to invest or divest in employees depended heavily on demand.

Divestments and investments take many different forms, of course. For example, the PwC survey found 63% of CFOs plan to invest in changes to products and services to rebuild or enhance revenue streams. Thirty-six percent expect to alter their distribution channels. Thirty-four percent will invest in talent. Thirty-one percent are exploring mergers, acquisitions, joint ventures, or alliances.

Clearly, CFOs are considering multiple approaches based on their businesses’ needs. Which approaches are the best will depend heavily on each individual business.

To make good decisions, CFOs will need to clearly identify their highest priorities and re-allocate capital accordingly.

This is an area where CFOs embracing digital transformation have come out on top: financial platforms that use automation to accelerate budgeting and forecasting make it easier to keep up with the real-time changes of the COVID-19 era. And critical revenue-centered technology like billing software—especially for complex recurring billing cycles and models like variations of one-time, usage-based billing, and hybrid billing—automates process and accelerates go-to-market opportunities providing CFOs the insight and agility needed for growth.

Concern #2: An uncertain future

McKinsey recommends scenario planning, but with so many balls in the air—including the coronavirus, the U.S. election, racial justice activism—the future is all but predictable.

As mentioned earlier, this kind of uncertainty calls for liquidity. In times of extended uncertainty, a growing number of CFOs are taking steps to create a cash culture within their organizations.

In 2020, CFOs “cannot take responsibility for working capital alone,” Craig Bailey of The Hackett Group asserts.

“Creating a cross-functional cash culture expands ownership and accountability for working capital levers and enablers, embedding cash preservation in strategic and tactical decision-making, and activity prioritization.”

Cash culture, as the name implies, requires a cultural change within a business. In it, capital performance becomes more transparent, cash vs. cost education and modeling are needed, and perceptions of inventor cost, service, working capital needs, and accounts receivable may be reframed.

Some CFOs resist this approach, especially if implementing it meets significant organizational barriers.

However, one report found that “75% of businesses are satisfied with their working capital management, but 41% have at least one working capital gap each year.” That’s quite a disconnect, especially considering above-average companies reportedly “manage working capital up to four times better than below-average peers.”

The cost of avoiding cash culture may outweigh the cost of implementation.

As Jason Lemkin at SaaStr pointed out, even though SaaS companies are well-positioned to weather this crisis, planning for 2021 has to look different than in the past. He recommends being more conservative than the current numbers suggest, and raising 9-12 months of cash if possible.

Whether CFOs are ready for cash culture or not, transparency and frequent communication with investors, partners, and other stakeholders will reduce anxiety and increase resilience. These are the actions taken by CFOs positioning themselves for the kind of joint ventures and alliances that can carry resilient organizations into the future.

Concern #3: Productivity and remote work

For years, many businesses resisted allowing employees to work from home. Executives, financial and otherwise, feared it would reduce productivity and affect the bottom line. When COVID-19 made remote work necessary, CFOs held their breath.

Some industries braced for a financial hit due to lockdowns. Others, like transportation and healthcare, rushed to accommodate increased demand. In both cases, businesses needed whatever employed staff they had to put in the work.

So, are productivity fears founded? At first glance, it certainly doesn’t seem so. By some measures, U.S. workers were 47% more productive in March and April than in the same two months a year ago.

The CEOs of Slack, Cisco, and Okta Inc. all reported a productivity pickup. Some companies, like Twitter, may never require employees to return to the office.

However, as the months wear on, work-from-home burnout seems to be emerging. A series of remote work reports from software company Aternity has recently uncovered a “productivity tax” stemming from ongoing remote work. In the U.S., where 85% of enterprise business employees were still away from the office in July, overall productivity dropped 14%.

Meanwhile, returns to the office in France, Italy, and the Netherlands all resulted in increased productivity—by as much as 113% in France.

“Better on-premise tech support from IT, superior hardware for resource-intensive tasks, and the elimination of slow VPN connections are all cited as potential reasons for an increase in productivity while back in the office,” TechRepublic explains.

Making financial decisions for COVID-19 and beyond

As CFOs persevere through the current crisis, they should know they’ll emerge on the other side into a forever changed business landscape. As a result, strategic planning, investments, portfolio shifts, and productivity initiatives will be crucial to success.

And because things are changing rapidly and the future is hard to predict, increased visibility and analysis of finances will be the difference-makers for resilient CFOs.

To this end, digital transformation and automation of forecasting and financial processes are the new standard. Platforms that act as a financial system of record, enable quick revenue recovery, and support cash culture provide data and agility in times of uncertainty.

CFOs increasingly choose platforms like Stax Bill for cash-culture alignment, improved flexibility, and granular insight of revenue operations.

If it’s not already a priority, CFOs should advocate for digitization in their organizations. Ask for tools that create rolling forecasts and provide dashboards with real-time financial information. These solutions will enable planning for various scenarios affecting investments, supply chains, and other disruptions sure to appear in the months and years to come.