It’s probably one of the most dreaded phrases in the recurring billing industry right now: subscription fatigue.

Scott Stein—an editor at CNET—recently left an Apple-services event dismayed at the different ways Apple Inc. is looking to charge customers, including iPhone services, Apple News Plus, Apple Arcade, Apple TV Plus, Apple Music, and iCloud.

“Suddenly, or more than ever, we’re subscribing to everything,” Stein wrote. “We rent the world we live in.”

What exactly does subscription fatigue mean, though?

From a customer’s point of view, it means they’re overwhelmed with subscription options. It starts simply enough. A customer signs up for one subscription, such as a music streaming service. They signed up on their computer, but later decide to listen to music on their phone. They can’t remember their password, and want to try a different music subscription anyway, so they subscribe to a second music streaming option. After all, it’s only another $5.

Fast forward a year and two subscriptions become four, then six, while their credit card gets pinged for payments numerous times a month. Suddenly, it’s all too much to even think about. Subscription fatigue sets in and they cancel everything.

There are signs of subscription fatigue in the marketplace, but does this constitute a real threat for the subscription business model?

The subscription business model is growing in popularity… but so is churn

So just how widespread is the subscription business phenomenon? According to McKinsey & Company, 60% of women have at least one subscription, while the average subscriber—regardless of sex—has two subscriptions, and almost 35% have three or more. Breaking it down even further, 42% of men and 28% of women subscribers have three or more subscriptions.

However, churn rates are also high, which is bad news for businesses that depend on subscribers. Churn makes it harder for these businesses to cover costs and plan their scaling efforts. McKinsey’s report goes on to say 40% of e-commerce customers have canceled subscriptions.

And customers who do churn tend to do so relatively quickly. One-third will cancel their subscription less than three months into the relationship, and more than half will cancel within six months.

Subscriptions reach across SaaS and other industries

The subscription business model has been around for centuries, starting with periodicals in the 1600s. In the digital era, this model began in the SaaS industry, where it quickly gained ground. So much so that most startups are electing to adopt this model from the outset. Established businesses are also converting from the transactional sales model—where a unit is purchased once—to subscription business models.

The SaaS ecosystem has reaped tremendous benefits from this strategy. The average business with more than 50 employees subscribes to about 25 to 50 SaaS applications, while businesses with over 250 employees subscribe to greater than 100.

SaaS businesses were worth $72.2 billion in 2018, and that number is expected to grow to $113.1 billion in 2023, largely due to recurring billing.

Microsoft, for example, is a huge SaaS winner. While users can still purchase its software up front versus on a subscription basis, Microsoft 365 has 33.3 million users. In 2019, its stock pushed past the $1 trillion mark, making it the third U.S. business to hit that milestone, behind Apple and Amazon.

And no matter where you look, innovative businesses such as Veeva—a cloud-computing company that focuses on pharmaceutical and life sciences industry applications—are building on successes in their industries, while others like Brex—a cloud-based fintech company—are gaining attention by disrupting industry norms.

Automotive legends such as Porsche, BMW, and Volvo are also diving into the subscription model.

For example, a Care by Volvo subscription gives customers not only the car they want but also access to insurance, service, maintenance, and repair options. Additionally, it offers extra services, such as pickup, delivery, and concierge assistance.

Fair makes more affordable cars available through subscriptions as well. With no long-term commitment, customers can select any of the business’s available cars for as long as they want the car—from two months or two years.

Fair founder and CEO Scott Painter explained in a 2018 interview that, “fundamentally we all know that the process of buying a car is broken but so is the whole experience of owning a car. The average automobile costs about a third of somebody’s net worth around the planet… and [people] incur about four trillion dollars’ worth of consumer debt every year.”

He sums it up this way: “It really starts with figuring out how to leverage technology and then underwrite the transaction.”

Subscriptions in the retail industry

Gartner—a global leader in research and advisory roles—has said that by 2023, “75% of organizations selling direct to consumers will offer subscription services.”

To date, about 70% of organizations are considering—or have implemented—subscription services, according to its Digital Commerce State of the Union survey.

Retailers are jumping into the subscription market with both feet. McKinsey & Company breaks retail subscriptions into three major categories:

1. Replenishment, when customers subscribe to keep commodity items on their shelves, such as razors or laundry detergent. Target, for example, has multiple subscriptions available, from diapers to nicotine patches. Their invitation to “never run out of the things that run out” is a prime example of serving the needs of customers before they need something.

2. Curation, are more of the ‘surprise’ subscriptions, such as BirchBox or Stitchfix, where customers subscribe to a concept, but do not know exactly what they will receive until that month’s package arrives.

3. Access, where customers pay for exclusivity, such as additional perks. For example, Thrive Market gives users access to organic, non-GMO foods with up to 50% off normal retail prices.

McKinsey suggests access accounts for 13% of all subscriptions, replenishment takes 32% of the pie, and curation tops out at 55%.

Is subscription fatigue a concern for every industry?

Some industries seem to be associated with subscription fatigue more than others. For example, video streaming services were once hailed as the best alternative to cable subscriptions. But the number of streaming options keeps growing. Last year Amazon Prime customers could watch several Nickelodeon shows. Now, many shows created by the popular kids’ network are only available for an additional subscription through NickHits.

But others say subscription fatigue is a real threat in the entertainment industry.

GlobalWebIndex reports 33% of people surveyed say they wouldn’t pay for another OTT subscription because they have enough options already, and nearly one in five people say they have too many subscriptions.

Additionally, GlobalWebIndex reports 36% of people state its simply getting too expensive to pay for multiple services.

The median annual churn rate for SaaS businesses that earn under $10 million annually is 20%, but this number varies greatly depending on the size of the customers these businesses are targeting as well as the length of their contracts.

Another indicator that customers may be developing subscription fatigue is the emergence of consumer focused subscription management apps. Subscription customers may be taking advantage of more than one of the apps available so they can track their spending or keep on top of price increases. For example, Truebill not only brings all of a customer’s subscriptions together, but it also provides the contact information a customer will need if they decide to cancel a subscription.

Combating subscription churn

If GlobalWebIndex is on point by reporting one in ten people would first cancel a subscription before subscribing to another, the pressure is most certainly on for all subscription businesses to demonstrate the value of their product to stay ahead of competitors.

Now more than ever, recurring billing businesses need to make sure customers are delighted with their products and services. It’s also essential to make sure customers feel valued by your business by providing superior customer service. This means solving issues the first time and keeping them engaged with your product.

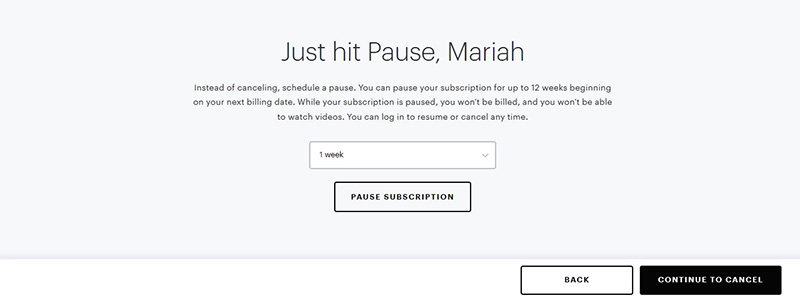

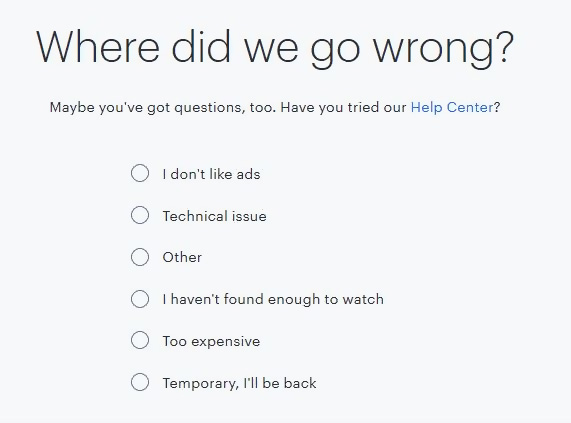

And if they do decide to call it quits, don’t burn your bridges. Make it easy for them to cancel… physically. Take the cancellation messages from Hulu, for example.

Offer help by giving them other solutions. If that isn’t enough, it’s okay to ask why they want to leave. After all, you can use this information in the future with other customers.

You could also try to entice them with other options.

And if all else fails, just say farewell. Hopefully not forever, but leave them with a good feeling.

Subscription fatigue may or may not be a growing threat, but knowing that customers might be experiencing some subscriptions weariness underscores the fact the subscription business model is actually working. It’s not a passing fad; subscriptions are here to stay.

If anything, the subscription business model and markets are evolving. Keeping in mind subscriptions have actually been around for centuries, it’s not surprising we’re seeing changes.

If subscription fatigue is here or on the horizon for your industry, is your business ready to rise above your competitors?