Ahh, revenue recognition.

Okay, okay—I know it may not be a topic you’re excited to read about. And it might not even be one you feel very knowledgeable about.

But bear with me. There’s going to be some good stuff here.

When it comes down to it, accurate revenue recognition is extremely important, and not just for this vague idea of ‘compliance’—although it’s very important and we’ll cover that too. It’s also important because it can actually help your business make money.

Oh, now you’re interested?

Let’s dig in.

How should revenue be recognized in a SaaS business?

“Most SaaS companies I have spoken with are incorrectly recording their most important revenue stream,” Ben Murray, the SaaS CFO, wrote in his guide to deferred revenue. “That is SaaS subscription revenue and the corresponding deferred revenue balance.”

It’s easy to mess this up because the right way to recognize subscription SaaS revenue is very different from how a more traditional business would recognize revenue from the one-time sale of physical goods.

Murray went on to share that, in his experience, proper revenue recognition isn’t a priority for many SaaS businesses. They outsource their accounting to experts who aren’t necessarily familiar with the SaaS business model. And these external accountants compile the businesses’ financial statements but do the accounting in a way that recognizes revenue immediately.

So how should it be done?

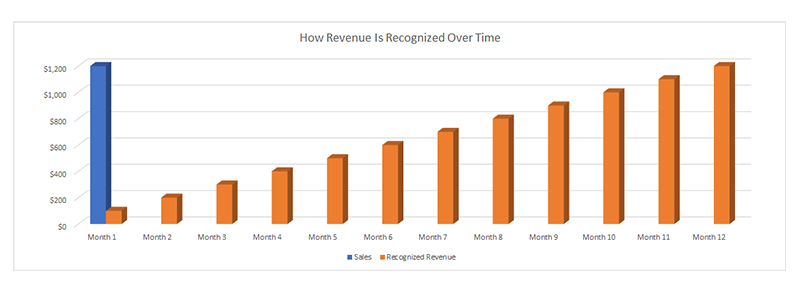

Let’s say your SaaS business charges customers $1,200 at the start of each year for an annual subscription.

You’ve made the sale and collected the payment, but you haven’t actually earned all that money yet because you haven’t finished delivering the service.

To recognize the revenue properly, you’d:

- earn 1/12—or $100—of that $1,200 each month, and

- maintain the balance in a deferred revenue account until the year is complete.

At that point, your business has successfully delivered its service in full and can recognize the total $1,200 amount as earned revenue.

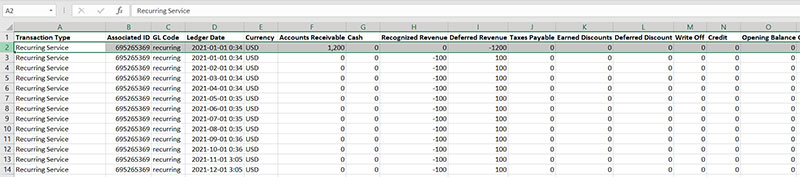

Here’s how your ledgers would look from the beginning to the end of a 12-month subscription period.

Deferred revenue is a liability for your business. That means it should be reflected on your cash flow statements. And, as investor and business mogul Richard Branson has said, “Never take your eyes off the cash flow because it’s the lifeblood of business.”

Let’s take a look at three ways accurately recognizing your revenue can benefit your business.

1. Remain in compliance by accurately recognizing your SaaS revenue.

ASC 606 is a relatively new standard for revenue recognition—having gone into effect in 2018 for public companies and in 2019 for private businesses—and it’s basically the dictator of the process detailed above. It was jointly developed by the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) to bring more uniformity to the way businesses recognize their revenue.

It’s not exactly a simple guideline to adhere to, and unfortunately it’s not an optional one either. While the ASC 606 standard isn’t law, businesses can face penalties for non-compliance, enforced by the Securities and Exchange Commission (SEC).

And if a business gets caught violating the standard?

Jokes aside, improper revenue recognition is a real fraud risk.

Around 60% of businesses investigated for fraud by the SEC in the past decade had inaccurately recognized revenue.

And the only thing worse than being penalized by the SEC is being penalized by the SEC without realizing you had anything to be penalized for.

Prioritizing accurate revenue recognition in your SaaS business lessens your risk by helping you stay in compliance.

2. Accurate revenue recognition helps you ace surprise audits

An auditor can ask for all kinds of financial information, including your general ledgers and financial statements.

The best way to prepare for an audit? Follow best practices year-round.

- Consistent and accurate revenue recognition ensures your business is prepared for whatever comes its way during an audit, and

- having all your financial information correctly recorded and organized according to GAAP standards means you have what you need ready at your fingertips to answer any questions from the auditor.

One big “don’t” when it comes to recognizing revenue? Doing it manually.

Many businesses still use spreadsheets to track their subscriptions and revenue. Don’t get me started on why you shouldn’t rely on this kind of manual system for recurring billing operations.

Seriously, I could go on for days.

When it comes to accurate revenue recognition specifically, manual processes:

- are inefficient and time-consuming (maybe even impossible, after all, a thriving SaaS business can easily generate over a million journal entries in a single month),

- create potential for inaccurate numbers due to human error,

- mean your business is lacking a paper trail if documents are continually edited and saved over, and

- make important financial documents difficult or impossible to access by other team members if saved locally on one person’s computer.

An auditor discovering any revenue recognition errors for any reason, unfortunately, can mean more fines.

There’s good news, though. Accurate revenue recognition does more than just spare you from fines…

3. Impress stakeholders and attract investors with your accurate financial records.

Board members, lenders, investors, and other stakeholders rely on detailed financial records to get an accurate picture of your SaaS business’s overall health. And they use this information to make decisions about whether to approve your strategies or give you money to fund your growth.

So when there’s a due diligence deep dive into your bank statements and financial records, you need them to prove clearly that your business is achieving what you say it is.

To be frank, without a clear line of sight into your business’s assets and liabilities, these stakeholders aren’t likely to be interested in helping your business. You risk derailing your growth momentum and potentially your next big round of funding.

Consistently clear and accurate records, on the other hand, will increase your credibility in their eyes and make it more likely you’ll secure whatever type of approval or funding you’re looking for.

4. Collect everything you’re owed through automated billing.

With the help of adaptive automated billing software, accurate revenue recognition can be…well, automated. You’ll never have to second-guess your numbers, you’ll free us a ton of time for your finance team, and you’ll ace any surprise audits. You’re also a lot more likely to secure your next big round of funding.

And using an automated billing system to take care of revenue recognition has its own moneymaking benefit too: it facilitates seamless proration.

Many subscription businesses that bill manually don’t prorate charges for customers that sign up for services partway through a billing period. Rather than going through the process of calculating the difference, they often just opt to give services for free until the start of the next billing period.

This saves a lot of work for the billing department, sure, but it’s also a huge lost revenue opportunity.

Prorating subscriptions and recognizing revenue go hand-in-hand, since the daily cost of service needs to be calculated for both. Your billing system would already be calculating the cost of partial billing periods, so your billing team wouldn’t need to worry about doing it by hand. That means proration happens automatically and your business gets paid from the moment a new customer signs up.

I told you accurate revenue recognition could make your business money.

Get Strategic with accurate revenue recognition

Accurately recognizing revenue for a subscription-based business is a complicated endeavor—especially if it’s being attempted manually. And of course, non-compliance can result in hefty fines from the SEC.

Inaccurate revenue recognition can also:

- cause your business to be passed over for loans and investments, and

- negatively influence stakeholder and public perception of your brand.

While these ramifications won’t cost you money in the form of fines, they certainly put a huge roadblock in the way of scaling your business.

If you haven’t put a lot of thought into revenue recognition, the time is now. Once your SaaS business starts clearly and accurately recording its earned versus deferred revenue—its assets versus its liabilities—you’ll be more in tune with your cash flow and in a much better position to make strategic decisions that help you grow with confidence.