In 2013, the European Space Agency (ESA) launched an observatory called Gaia. Its mission? To construct the largest and most precise 3D space catalog ever made.

It would require a lot of data.

The project would observe more than a billion stars in our galaxy. Building an in-house solution to process the data would cost the ESA an estimated €1.5 million; a steep price for a level of processing that would only be needed for two weeks every six months.

So, what did the ESA do? Understandably, they sought out other options. They were in luck: Amazon Web Services had the capacity to process the six-year data set, at the required frequency, for less than half the price.

Why pay for something when you’re not using it?

Just as consumers are turning to apps to detect unused subscriptions charges, so are businesses seeking opportunities to reduce expenses on products and services that are only accessed on occasion.

One way this has affected the B2B (business to business) market is in the recent rise of usage-based pricing.

Usage-based pricing: a new frontier in pricing disruption

The subscription model is upending ownership. From multiple streaming services changing the movie industry, to rideshare businesses threatening to replace car ownership, it was only a matter of time before this culture shift began to permeate the B2B world.

Add usage-based pricing, charging only for each unit of data streamed or each mile driven, and disruption is here.

There are benefits to usage-based pricing on both sides of a B2B transaction. For the client, the cost of a product or service only rises at the same pace as their business scales. If market volatility causes a particularly dry quarter, usage will reflect that, and cost will lower accordingly.

Usage-based pricing also reduces up-front costs, which can be prohibitive for small businesses. In the case of software, it can also reduce the need to pay for new product versions as they roll out. Larger enterprises aren’t left out: they still benefit from the more granular data offered by the information-gathering technologies utilized in usage-based pricing.

For the vendor, the steady stream of revenue generated by regular usage ensures the ability to keep up with research and development and market trends. What’s more, tracking usage means tracking dips and rises. This can signal changes in the market, which require proactive steps to stay relevant.

Tracking user behavior with the same technologies used to track application usage, of course, offers yet another insight to help keep a business healthy.

Paying, and charging, only for what is used isn’t just desirable—it’s fair. As the market moves toward more customer-centricity, it’s important for businesses to evaluate whether using a usage-based pricing model is right for them. For some businesses impacted by this pricing disruption, it’s time to disrupt, or be disrupted.

Tracking usage thanks to the IoT

Just as with Gaia, usage-based pricing relies on processing a lot of data. Whether gigabytes streamed or minutes on the road–we can’t record, analyze, and charge based on this data today without the Internet of Things (IoT) and, in the case of vehicles, telematics.

Today’s high internet speeds, cloud computing, and smaller, more affordable IoT sensors have taken the Information Age to a new level. Data is more plentiful and accessible than ever before, and rapidly evolving technologies make it evermore possible to react to it swiftly.

Adaptive billing platforms, for example, intelligently analyze and invoice based on large amounts of information, enabling usage-based pricing on a level never before seen. Cloud technology removes the need to build expensive in-house solutions that allow dynamic pricing models while also tracking and mining customer activity.

Customers today see the competition’s pricing and promotions with just a few taps of their thumb. They are more informed and need less time to make decisions.

Usage-based pricing allows customers to clearly see and understand what they are paying for. This both attracts customers, and reduces churn. With transparency and real-time data at the forefront of transaction expectations, getting on board with these technologies is simply a smart business move.

How are businesses harnessing these new levels of data to inform pricing? Here are three models on the rise:

1. Flat tier pricing

Possibly the most common SaaS (Software as a Service) pricing model, a flat tier, usage-based approach offers more than one “level” of account. The cost of each tier reflects how much usage is available by signing up for that tier.

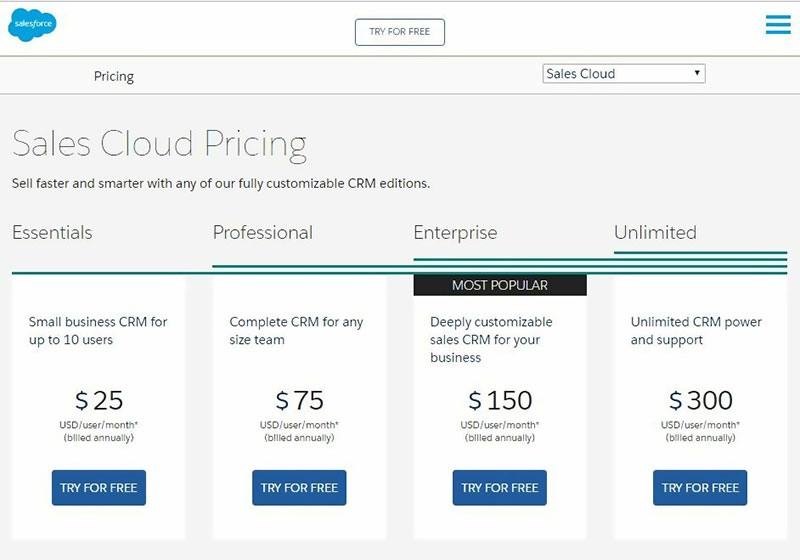

Salesforce is a well-known example of a flat tier provider:

Each tier of Salesforce’s tiers provides access to more tools and services. How the client wants to use the platform dictates how much they will pay per month to do so. Additionally, the number of users on that client’s account affects the invoice at the end of the billing cycle.

Salesforce needs to track how many users are on each account, and be ready to increase/decrease access to tools and services if the client upgrades or downgrades. Complex tracking, analysis, and invoicing are best reinforced by a cloud-based, data-driven recurring billing platform able to pivot around an active business’s needs.

2. Subscription + overage pricing

Imagine that a Salesforce client is happily paying for their Professional tier subscription. Then, one month, that client wants to run a promotion that would be helped with a tool found only in the Enterprise and Unlimited tiers.

What should the client do?

The way Salesforce’s pricing model is designed, the client will need to upgrade to the next tier for the month, and remember to downgrade at the end of the month to avoid being billed at that price again.

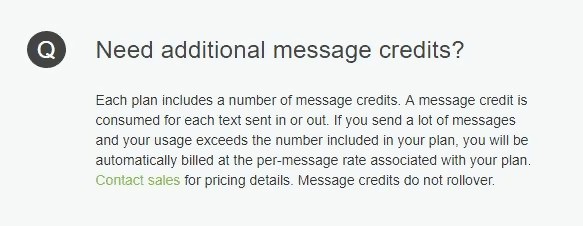

Some businesses, like TextMarks, do things a little differently. TextMarks sends mass texts and SMS messages for businesses. Like Salesforce, they have tiers to their subscription service, with tiers based on the number of texts to be sent, level of customization, white-label service, auto-responses, and other features.

Each tier has an allotted number of permitted texts for the month. But what happens if a business needs to exceed that number? Does the texting campaign get put on hold? Worse, do customers receiving the texts stop getting responses when they reply?

TextMarks puts these worries to bed. In this case, usage is measured by the number of texts sent:

You can also see an example of subscription + overage if your business signs up for an All Access Plan with the rideshare app Lyft. Under this plan, a monthly fee covers a certain number of rides for the month. All rides past that number are available at a discount.

3. Linear, or pay-as-you-go pricing

Pay-as-you-go pricing bills customers strictly for their usage, such as the metered billing often associated with water or electricity utilities. Customers are invoiced at the end of a billing cycle based on their consumption.

The difference between subscription + overage and pay-as-you-go pricing models is in the usage. In the former, the base price covers a certain amount of usage, and anything over that usage is an “overage.” In the latter, a base price does not include any usage; all usage is billable.

Pay-as-you-go appeals to consumers as it puts a measure of control into their hands. However, this model intimidates many businesses, as there is little—or even no—flat monthly or annual fee to depend upon from clients. Instead, a provider must trust that their clients will use their product enough to keep revenue flowing in.

Companies like MetroMile, a vehicle insurance company, recognize the appeal to consumers. MetroMile offers insurance which charges, you guessed it, per mile. As their CEO Dan Preston says, “The less you drive, the less you pay.”

Mileage-based insurance attracts vehicle-dependent businesses and their fleet managers. Add in discounts for safe driving tracked by IoT sensors and telematics, and this exciting new pricing model may just be the disruption that defines our economy’s future.

The popularity of pay-as-you-go pricing could drive permeation into almost any area of the marketplace. Even Dell Technologies has entered the space with a ‘flexible consumption’ model for its technology solutions.

What pricing disruption means moving forward

There is an increased demand for transparency, real-time updates, and customized pricing. As a result, it’s no surprise that disruptive pricing models are developing at light speed.

The technologies enabling these developments, such as customer tracking, don’t only affect a business’s ability to offer and charge based on usage. They also inform pricing on the front end.

For example, knowing customer purchase patterns—such as what price point a customer has purchased a product before—can help sift out promotional pricing for audience targeting. Even responses to a promotion helps refine customer data to inform pricing development.

With increasing sophistication, artificial intelligence (AI) technology powers price optimization in many ways. For example, automated algorithms and machine learning can track the most successful pricing for closed deals. They can then apply that knowledge to an automated approval system that reduces the need to reach out to a manager for special approvals.

Handling all of this, of course, requires technology that allows you to make changes quickly without relying on technology resources. For flexibility and adaptability of pricing models that respond quickly to rapidly-changing markets and competitive pressures, an adaptive billing system can help. A system such as Stax Bill’s platform can adjust to new pricing and ensure accurate invoicing for every account.