Until recently, businesses might have been advised to prepare for a marathon and not a sprint when undertaking digital transformation.

For small- to medium-sized organizations, the process might have been several months to a year. And for larger enterprises, it might have taken several years.

But times have changed. Businesses are now being forced to expedite that lengthy transformation process. Thanks to the COVID-19 pandemic, digital connectivity is at the forefront of the world’s new normal.

For example, telecommuting has become routine for many industries—even some that previously prohibited it. And the cloud is enabling seamless work collaboration and connectivity.

Product and service delivery methods have evolved across the board, with grocery, restaurant, retail, and even health services embracing online and on-demand options. And there have been numerous businesses in the SaaS space that have seen exponential growth because of how the pandemic has shifted business and personal life.

Businesses in all industries are adopting new SaaS technologies, enabling them to establish and maintain effective remote environments for the foreseeable future and beyond.

Shopify is a great example—a SaaS that saw nearly 100% year-over-year revenue growth between 2019 and 2020 as many businesses turned to e-commerce solutions to satisfy consumer demand. And Zoom became the most downloaded application in the App Store in Q2 2020. In the U.S. alone, Zoom was downloaded a reported 90 million times that quarter.

Digital transformation and subscription revenue operations

An increasingly important area for digital transformation is revenue operations, or RevOps.

There are several business units that form RevOps.

- Marketing operations: The customer touchpoints for this unit include campaign management, lead management, data management, marketing analytics, and technology management.

- Sales operations: This unit often connects with customers across territories and actions the quote-to-cash. It also manages data, sales reporting, and analytics, along with sales technology.

- Customer success operations: Onboarding customers, managing churn, and initiating renewals/upsells all fall to this unit. It also manages customer data and analytics through the post-sales customer journey.

- Finance operations: This unit handles subscription billing policies and procedures, terms and credit approvals, revenue data, finance reporting and analytics, and financial technology (FinTech).

RevOps is the alignment of these units or teams at an operational level to ensure customers enjoy a seamless experience throughout their journey with a subscription business. Needless to say, this alignment positively supports top-line business success.

But achieving effective RevOps requires the transformation of a business’s people, processes, and technology to support it. Breakdowns in communication, processes, and digital pathways between departments functioning in a siloed capacity—or independent from each other—ultimately lead to performance gaps and missteps that undermine customers’ high expectations.

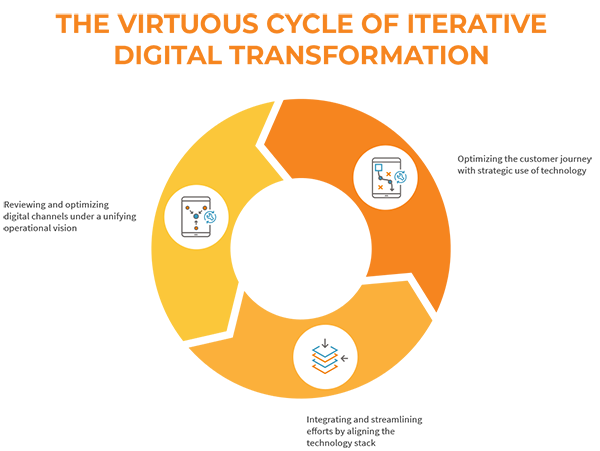

There are endless options when it comes to digitally transforming a business’s RevOps. But transformation can be simplified into three main efforts:

- Reviewing and optimizing digital channels under a unifying operational vision

- Integrating and streamlining efforts by aligning the technology stack

- Optimizing the customer journey with strategic use of technology

Optimizing RevOps for increased MRR and LTV

Reviewing and optimizing digital channels is about really taking stock of the tools a business is currently using and how it’s using them. The objectives should be focused around the following.

- Unification of key processes

- Well-aligned technology stack

- Strategic use of data and technology: Enhanced monetization with cloud subscription billing

A report released by SiriusDecisions found businesses that have optimized their RevOps grow 19% faster and are 15% more profitable.

Many back-office functions are now integral to revenue optimization, and a good chunk of these back-office activities occur within the financial operations (FinOps) side of a subscription business.

Billing operations is one such function that’s an increasingly important facet of FinOps and is required to support successful RevOps execution.

Your subscription billing engine is a hugely underemphasized aspects of your business’s RevOps. After all, you can drive all the revenue in the world through marketing, sales, and customer success. But at the end of the day, you need to invoice and collect on your sales to maintain a healthy cash flow and keep your business moving in the right direction.

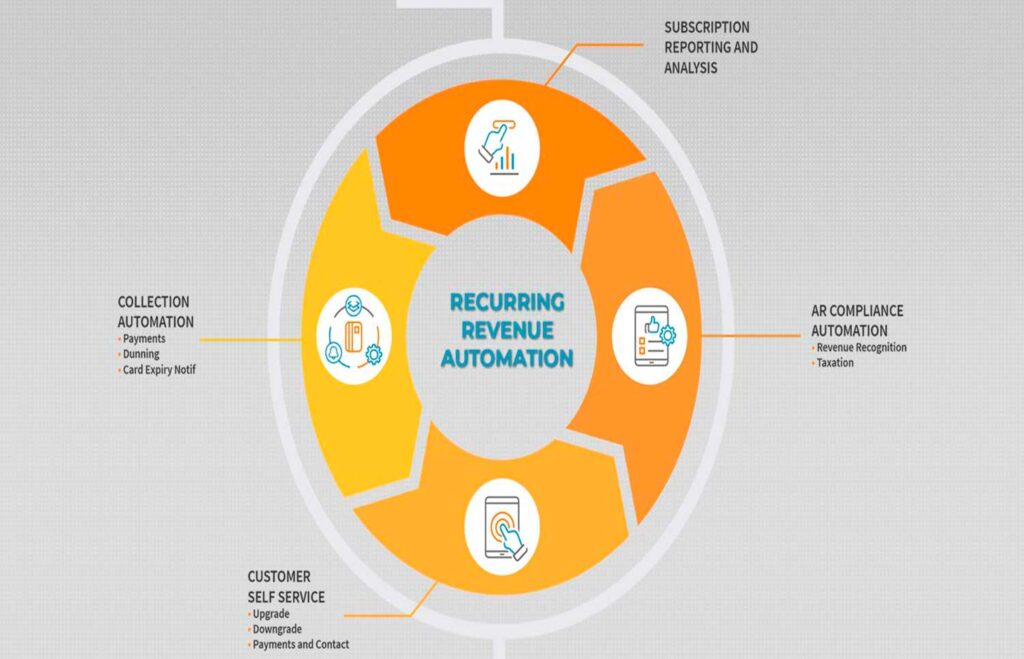

As the subscription business model continues to grow in popularity, transforming processes with an automated, agile recurring billing and customer management platform brings in many different components to help companies align and successfully deploy their RevOps processes.

Performing all of this—and in real-time—is crucial for monetizing recurring products and services.

The above is an excerpt of the detailed whitepaper on what it takes to execute a comprehensive RevOps plan under a digital transformation umbrella.