Losing customers (and revenue) to involuntary churn is a major bummer, and while crafting dunning communication isn’t always fun, it can play a huge role in reducing your churn rate.

One of the most common causes of involuntary customer churn is failed payments. So, even though existing customers are happy with your service or product and otherwise would have continued their subscriptions, these customers churn because their payments don’t go through. Sometimes they don’t even realize it’s happening.

Common causes for failed payments include:

- credit cards expiring,

- incorrect or outdated billing information,

- credit cards being maxed out, or

- cancellation of a credit card (if it was lost or stolen, or the customer switched to a different card).

Subscription SaaS businesses average a loss of around 9% of their monthly recurring revenue (MRR) to this type of involuntary customer churn. Yikes.

The simplest way to avoid this particular leak in your revenue bucket is, of course, dunning management practices—which, in the context of involuntary churn, boils down to asking your customers to update their billing information so you can charge them.

However, dunning communication can feel daunting or even awkward, and there are a lot of variables to consider. Here are four tips to help you streamline your dunning processes, reduce churn rate, and ultimately earn more revenue.

1. Automate both proactive and follow-up dunning communications

Manual dunning communication takes a lot of time, especially as your SaaS business grows. Your finance team’s time and energy can be put to much better use than manually tracking down expiring cards and delinquent payments and/or sending out dunning communications by hand.

Beyond saving hours of work, automated dunning communication can help reduce day sales outstanding (DSO)—essentially, how long it takes to collect receivables.

According to the B2B Payments Innovation Readiness report, “The degree of automation used in managing AR strongly relates to firms’ ability to shorten their collection cycles. The DSO of the typical firm with no or low levels of technological implementation for managing AR is 52 days, for example. That is 12 days more than firms that have moderately to highly automated AR processes.”

So what does this automation look like in practical terms?

Set up automated messages to let customers know ahead of time when their credit cards are expiring and give them an opportunity to update their information before you attempt to charge them. If a payment fails, send them messages letting them know what happened and how they can resolve the issue.

And, as we’ll discuss in more detail later in this article, creating automated credit card retry sequences and implementing a credit card auto-updating solution can also help reduce failed payments significantly.

This automation not only takes the heavy lifting out of dunning communication, but it also helps eliminate manual errors—it’s a win-win.

2. Optimize your messaging and pacing

It can feel awkward to let a customer know their payment has failed, and as a result, many SaaS businesses send rambling, wordy dunning communications in an effort to avoid offending customers.

Or, worse yet, they don’t send any dunning communication at all.

Craft the perfect dunning messages with these tips:

- Write a compelling subject line. Obviously, you need your customers to actually open your email in order for your dunning communication to be effective. Include your business’s name and something like “action required” in the subject line to let the customer know right away that the email is important.

- Keep the message short. As many as 20% of people won’t even read an email that’s longer than one paragraph.

- Mention possible causes for the failed payment. Suggesting things that could have gone wrong can help customers identify the problem and solve it quickly.

- Be friendly and polite. Assume the customer isn’t aware of the problem, and give them the benefit of the doubt in your first couple of messages. Warn them they could lose their subscription, but keep the tone positive.

- Provide easy links. Include a link that takes the customer directly to their billing information so they can easily update it, and a link to your customer service department in case they need help.

- Try text messages. Text messages have an open rate of 98% and can get a much faster response than emails. Especially if you aren’t getting a response with your dunning emails, text messages can get through to more people and prompt a quicker reaction.

Craft a sequence of messages that increases in urgency over time. Again, the first couple of messages should be friendly, assuming the customer isn’t aware of the issue. If they don’t take action, ramp up the tone of your messages and subject lines to catch their attention.

Test out different cadences to determine what is most effective with your customers. While you shouldn’t hound your customers every day, sending several messages over a period of time is more effective than sending a single notice. You may wish to start with around five dunning communications in a 30-day period, see how that works, and adjust from there.

Although it can be tedious to perfect and implement your dunning communication sequence, keep in mind it’s easier and cheaper to retain customers than it is to gain new ones. Making the effort to prevent customers from involuntarily churning can pay off many times over.

3. Automate the credit card retry sequence

If a payment fails due to a technical issue or something easily fixable (i.e. the customer has hit their monthly spending limit), it’s often highly effective to try running the card again after a couple of days. It’s a simple fix, but you’d be surprised at how many businesses don’t know they’re allowed to do this!

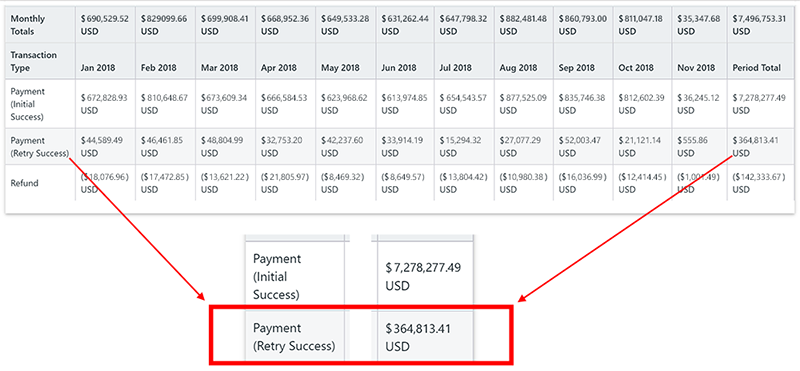

We often see this feature help businesses recover up to 75% of the revenue that would otherwise be lost to failed payments. In fact, we helped one business recover over $300,000 in a single year!

With a comprehensive SaaS billing system, you can build an automated retry sequence so your finance team doesn’t even have to think about it.

However, be sure to still alert the customer when their payment fails, and space out a few retries over a couple of weeks—don’t set your system to retry the card every single day. And, if the reason for the failed payment is more than a technical glitch, you’ll still likely need the customer to update their billing information. So, your dunning communication sequence should still kick in.

4. Consider investing in a credit card auto-update service

Most major credit card brands offer auto-updating services, which helps minimize failed payments and involuntary churn for your business. When a customer has a card on file with a credit card network and you subscribe to their auto-update service, you won’t have to worry about failed payments due to expiration dates that haven’t been updated, card numbers that have changed, or new billing addresses.

Many payment gateways also have this account updater feature built-in, so you don’t have to take the extra step of signing up for it—and you won’t have to bother your customers to update their credit card expiration date.

Most credit cards expire every three years, so it can become a full-time job just keeping track of upcoming customer credit card expirations.

Not so with an auto-updater!

Improve dunning management and decrease involuntary churn by automating billing with a solution

A comprehensive recurring billing software solution not only automates invoicing and billing, but can also handle automated payment retries, credit card updating, and dunning communication.

All of your AR information lives in one place which reduces manual errors, and the customizable automated features mean less tedious work for your finance team. In turn, this provides a better experience for your customers and makes your SaaS business more scalable.

Streamlined dunning processes help eliminate involuntary churn, take the guesswork out of dunning communication, and prevent revenue from being needlessly lost.