Ninety percent of text messages are read within three minutes. And in general, nearly 100% of text or SMS messages get opened. Adding to those figures, texts have a whopping 209% higher open rate than phone, email, or even Facebook.

What does all this mean for your subscription billing business?

It means that text messaging not only offers a new way for you to communicate with your customers, but it also presents a huge opportunity to reduce friction that can deter customers from acting on your messaging. And when that messaging is about an expired credit card or a late payment, it can make all the difference between cash in your pocket, and cash outstanding.

Building on the impressive statistics above, it’s well worth noting that business-based texting is a growing trend. It’s estimated nearly 49 million people will opt to receive business SMS messages in 2020. And since the average American is already checking their phone around 46 times a day, it’s clearly the most convenient and effective means of communication.

While the data above certainly skews higher for younger generations, this is even more reason why businesses should look to implement this functionality as a future growth strategy. Text messaging offers a distinct competitive advantage, a simple, automated way to reduce revenue leakage, and a practical way to tighten up your company’s subscription billing processes.

As the business world continues to evolve with an increasing focus on technology and seamless remote communication, you need to meet your customers where they are. This will help to position your business to forge ahead with success.

How SMS Can Support Your Automated Billing System and Payment Process

There are several different types of billing-related text messages your subscription business can automate to its customers. And each type tackles a potential barrier to getting paid.

1. Subscription Customer SMS Welcome and Opt in

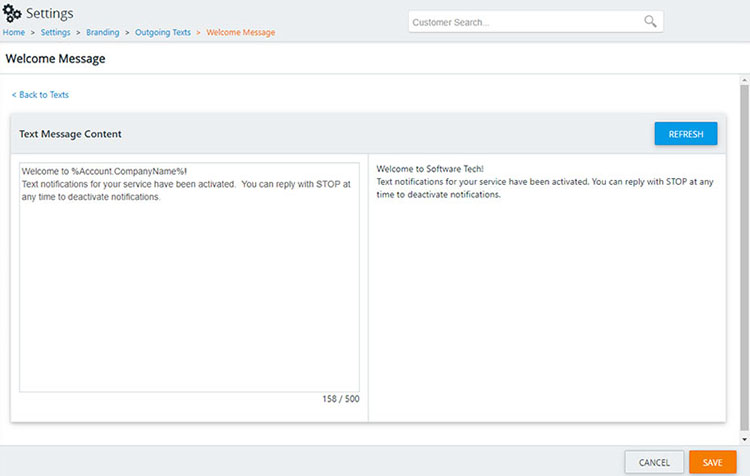

The first message you would send to your customers welcomes and introduces them to the SMS option. It also gives them the opportunity to reply STOP if they’d prefer not to receive communications through text messaging in the future. Customers can opt out from this first message, or at any time during the SMS relationship.

The welcome message is the first step in establishing a trustworthy SMS relationship with your customers, and it paves the way for all future billing-related texts.

2. Notify Customer Their Payment Method is About to Expire

Maintaining up-to-date payment methods can be a challenge in the recurring billing space. And if not managed with care, expiries can result in involuntary churn and a major hit to your recurring revenue.

Subscription billing businesses can use SMS to remind customers of impending expiries. For example, they may automate a text reminder 30 days prior to expiry, then 20 days, then 5 days before expiry takes place.

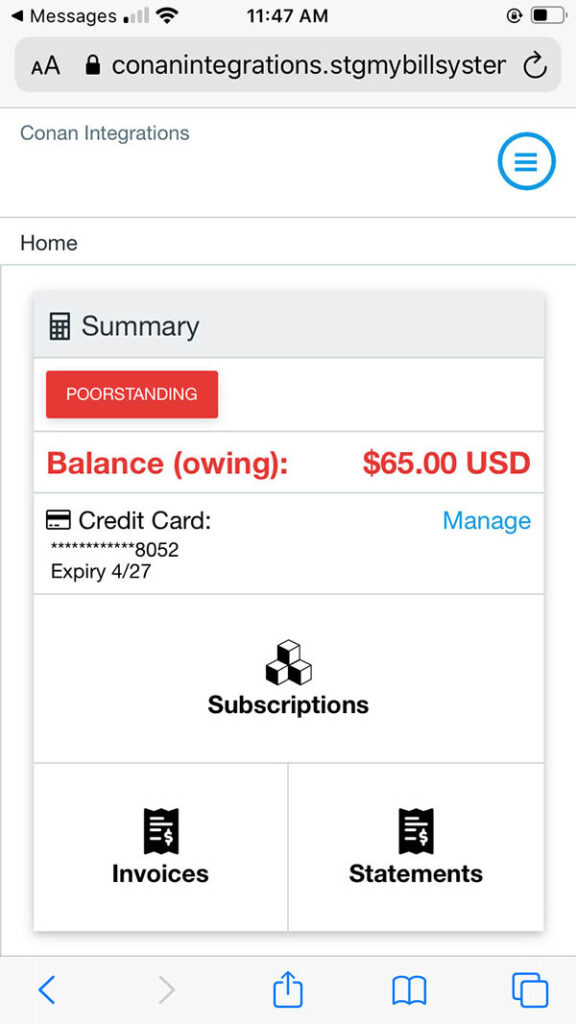

These messages would include a direct link for customers to hop over to their self-service portal, update their payment method, and carry on with their subscription and their day. It’s convenient for customers, and it’s a positive prevention tactic for your business.

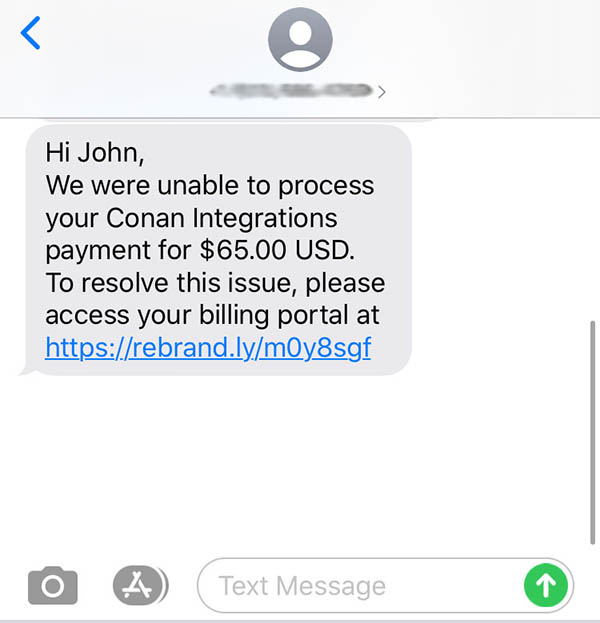

3. Notify Customer Their Payment Method Has Been Declined

While agile automated billing software will perform automatic card retries—which can result in completed payment up to 75% of the time—there are times when retrying a card won’t solve the problem. In these cases, customers need to take action to update their method.

This type of messaging to customers not only lets them know their payment has been declined, which can be helpful if they aren’t aware, but it also provides them with a link to automatically navigate to their self-service portal to update their payment method.

4. Notify Customer of a Late Payment

Late payments happen for many reasons: lack of cash, lack of time, and sometimes bills just fall through the cracks and get forgotten. By automatically pinging a reminder to customers to let them know they’ve missed a payment, you can incite immediate action. They see your message, and can easily click a link and make payment if they’re able.

While there’s not much you can do if your customer can’t afford to pay their bill, by removing as much friction as possible from the process of making payment, you dramatically increase the likelihood of immediate action from those who can.

5. Notify Customer of an Impending Subscription Expiry

While many subscription businesses run evergreen subscriptions—meaning they leverage automated renewals—some place automated expires on their customer accounts. In most cases, they do this because they have to in certain industries, such as insurance services for example.

Shooting your customer a text to let them know their subscription is about to expire further tackles that issue of involuntary churn we touched on earlier. And it’s an important part of your business’s retention strategy. It’s well-known that acquiring new customers can cost as much as 25X what it costs to retain an existing one. So once you get a customer, hang onto them!

Unfortunately, the need to contact your business and re-establish a subscription to active standing can be enough of a barrier for some customers that they will simply opt not to. Make it easy for them by eliminating that barrier and reap the retention benefits.

A few Negatives When it Comes to SMS

Just as the acronym implies, SMS—or short message service—requires brevity. There’s a limit to how many characters you can include in these communications, depending on the device and network. While this can be seen as a negative, it doesn’t have to be.

Clear and concise ‘get-to-the-point’ messaging is often most effective anyways. Afterall, research shows connected users only read about 20% of the content on a page, and the collective global attention span is on the decline.

The faster you get to the point of your message to your customers, the more likely they’ll take action on it.

Another potential negative of SMS is issues around security. Sending a message asking someone to navigate somewhere and enter their financial information can raise concerns.

The key to navigating similar concerns is to ensure every customer opts into your SMS from the beginning so it can be established as a trusted source for future communications and account activity. Customers can always scroll back through historical messages to confirm the source and their choice to opt in.

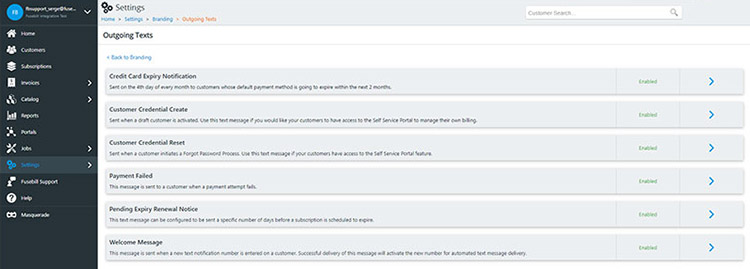

Choose Automated Billing Software That Enables You to Customize Your Text Messaging

The benefits of SMS functionality are clear, but just because you have a new way to communicate with your customers, it doesn’t mean you should change your company’s voice.

While you’ll need the ability to automate the inclusion of vital information such as customer names, your business name, and amounts owing on subscriptions, make sure to also select an automated billing system that lets your team tailor its text messaging to customers. After all, you know them best.

Timing is another important feature. Make sure your system is mindful of when automated messaging gets sent. No one wants to receive a text letting them know their payment failed at 3am. Ensure messaging is only sent during reasonable hours, and of course, based on the time zone of your customer.

Reduce Churn and Get Paid Faster With Automated SMS Functionality

Still on the fence about sending billing-related SMS messaging to your clients?

Consider that almost 70% of U.S.-based smartphone users already like to receive service-based texts from their financial institutions.

Online banking and peoples’ comfort with performing financial-related tasks on the go is on the rise and showing no sign of slowing. In fact, the number of mobile-banking users in the U.S. is already up to 57 million—more than 17% of the entire U.S. population.

Enabling text messaging from your automated billing system can be a great new way to connect with your customers in a way that already makes sense to them. It’s a competitive advantage that eliminates the barriers preventing you from getting paid.

SMS capabilities for billing also lowers your business’s rate of involuntary churn and reduces the amount of time your team needs to spend on updating customer accounts and chasing down payments.

In this age of increased competition and heightened unpredictability regarding the overall business environment, you simply can’t afford to miss out on revenue that will help you pull ahead because of a simple lapse in communication.