In August 2019, Texas-based B2B fintech firm, ScaleFactor received $60 million in Series C funding. This helped the company reach a $360 million valuation and pull in $7 million in annual recurring revenue (ARR) by the end of that year.

By August 2020, just one year later, it would close its doors for good.

While many businesses worldwide saw their bottom lines suffer due to the COVID-19 pandemic, many SaaS companies seemed to be poised to thrive.

So what went wrong for ScaleFactor?

After raising capital in 2019, the business hired dozens of customer support employees to keep up with its expected growth, only to lay off 40 of them a few months later—all pre-pandemic. Then, just a week before announcing its closure, the business shared on LinkedIn it would be taking on another round of new hires.

While we can’t say for certain these decisions had an impact on the business’s downfall, we can pull one piece of important advice from the cautionary tale of ScaleFactor: the importance of remaining objective when planning for the future—even when it feels like you’re on top of the world.

Receiving a big investment is exciting and opens doors to all kinds of potential opportunities. But having a strong sales and revenue forecasting process can help your SaaS business stay organized and make strategic tactical decisions to avoid a similar fate—even when unprecedented circumstances are thrown your way.

The benefits of forecasting for a SaaS subscription business

It’s true the recurring billing model is one of the best when it comes to pulling in predictable recurring payments—but as ScaleFactor and numerous other SaaS startups have experienced firsthand, it’s not a foolproof ticket to success, nor does it indicate invincibility.

To avoid the need to scramble and make reactive decisions, leaders of subscription-based businesses need to have a strong idea of what the business’s future sales and revenue look like so they can strategize accordingly.

And even if your recurring billing business never faces another crisis after this pandemic, having the tools to more accurately forecast your sales and cash flow can help you achieve strategic growth.

Spot and mitigate issues early

Continued monitoring and early detection of any problem is the key to solving it before it can do any significant damage. The same holds true in business.

For example, if your sales leaders can quickly identify when month-over-month sales are trending downward, there’s plenty of opportunities to find the root of the problem and course-correct in time to get back on track toward hitting quarterly and yearly targets.

The key to good forecasting is—above all else—consistently assessing and learning from your data, asserts Alexander Buchberger, partner at VC firm, Senovo.

“Revenue or sales forecasting is a process, not a simple gut feeling.[…]The average sales manager I met in my life [sic] was very optimistic and when it comes to his or her projections on sales quota achievements, judgment was poor,” he writes. “However, when it comes to sales forecasting, the forecast numbers should be as precise as possible.”

Subscription businesses need a clear picture of their future recurring billing to have a thorough understanding of their overall health.

Calculate cash runway and make resource management decisions

To scale, you need to reinvest some of your recurring payments back into your business in the form of technology or human resources that can help you work toward achieving that growth. But it needs to be done in a strategic and sustainable way—not blindly making a large round of hires now only to lay most of them off in a few months.

You need to know how big your cash runway is to strategically determine how much your business can spend on new employees, fancy software solutions, or new office space.

How many months can you continue spending at your current rate before you run out of money?

It’s always been an important number to know, but particularly so in the midst of a pandemic when many businesses have needed to be more cognizant of how they spend.

“Today a company needs to be more forward-looking and plan for long-term funding, and this is where [cash] runway comes to play,” says Vesa Riihimäki, Head of Startup and Growth at Finland-based universal bank, Nordea.

- Using your forecasted sales data along with your calculated cash runway helps you clearly understand how long your funding will last so you can manage resources accordingly.

- When everything is trending upward, this can mean hiring new employees or purchasing new tech, which is great.

- But—especially recently—it’s also about knowing when to cut business costs and get leaner in certain areas. Sometimes this can require some out-of-the-box thinking.

This is part of the reason why so many businesses have been accelerating their digital transformation agendas since early 2020. Legacy software and manual solutions are time-consuming and hard to use, whereas an agile SaaS solution decrease costs by improving efficiency.

How subscription businesses can forecast future sales and recurring billing

Subscription businesses rely on recurring payments from existing customers in addition to revenue from new sales. Therefore, both revenue streams need to be considered when building a data-driven strategy.

Now, there are many different methods for forecasting sales and revenue—enough to warrant a whole article in itself. But regardless of how you choose to forecast your business’s sales, there are a few data points you should have ready to go.

- Past performance—everything from new sales to ARR

- Any company changes that may affect this year’s sales as compared to last year’s (i.e., more employees, updated pricing, new products, etc.)

- The amount of potential revenue currently in your sales pipeline

- The probability of renewals, upgrades, or add-on sales for existing customers

- Historical contraction MRR and churn rate

Accurately forecasting sales and revenue from subscription billing for your SaaS business calls for as much data as possible.

So where can you get that data reliably?

How a recurring billing system helps with revenue forecasting

Adding a subscription billing solution to your recurring billing process creates a gold mine of financial data your subscription business can action. This software handles more than just sending invoices and accepting credit card payments. It acts as a holistic subscription management platform complete with reports that can teach you more about customers’ subscription lifecycles.

This alone is helpful for scaling your operations—PwC reports businesses that make data-driven decisions actually make 3X better decisions compared to those that don’t.

When it comes to forecasting your future sales and recurring revenue, there are two key reports you can leverage.

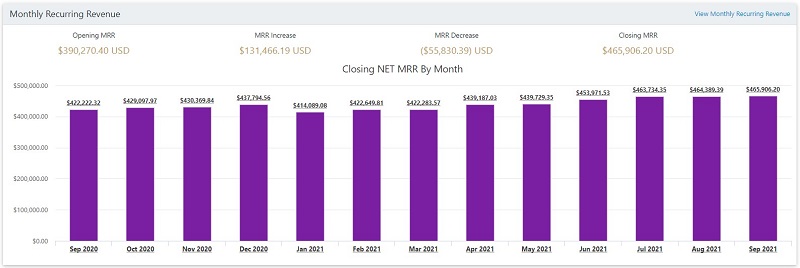

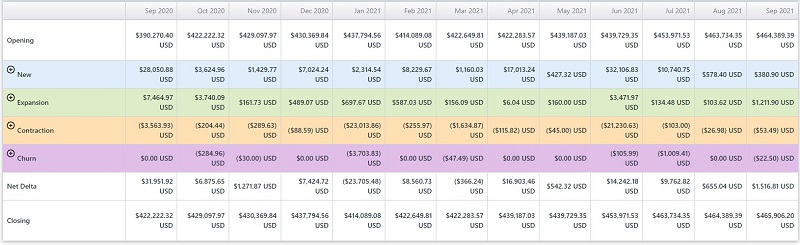

1. MRR reports track business trends.

You can derive a lot of different insights from your subscription billing platform’s MRR reports. For example, one key insight is month-over-month revenue from new and existing business.

Having this info at your fingertips enables you to:

- calculate your business’s average growth rate, and

- set realistic sales targets based on recent trends.

Your MRR reports can track data on existing customers, too, and provide information around upgrades (expansion MRR), downgrades (contraction MRR), and churn rate.

While these mid-subscription changes tend to have a less predictable pattern than new sales, having at least an approximate idea of your expansion, contraction, and churn rate can increase your accuracy when putting together those forecasts.

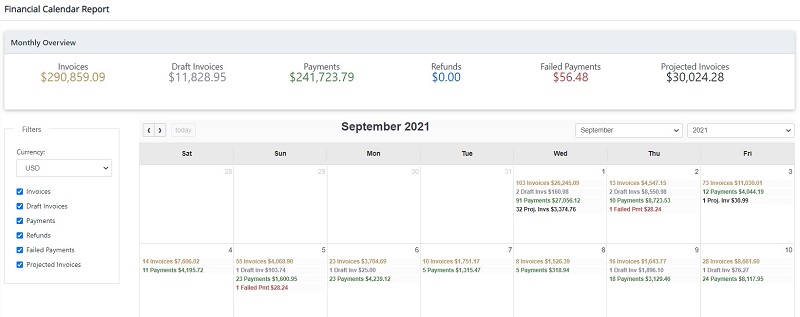

2. Calendar reports track anticipated recurring revenue from existing customers.

If you were to sign up zero new customers for the next year, how much revenue would your business continue to pull in?

Modern subscription management platforms can show you this, too.

Features like financial calendar reports enable you to see all your future projected invoices at the monthly, weekly, and daily levels, based on your customers’ current active subscriptions. This recurring billing granularity gives you a clear picture of what your cash flow looks like in any given month—and for the next twelve months.

This kind of report may also include historic financial data, such as:

- payments processed

- refunds given, and

- failed payments—more records that can help you identify previous trends for future forecasting.

Forecasting sales and recurring revenue is vital for SaaS business growth

There’s not much the right data can’t help you with, and it’s no different when it comes to sales and revenue forecasting for your subscription business.

Whether you need to track your sales team’s progress on their targets, map your recurring billing process and cash flow situation, manage business resources, or prepare revenue reports or growth projections for your board of directors, the forecasting capabilities of your recurring billing system can help you build strategies that see your subscription business scaling today and for years to come.

And in some cases, this level of insight can be the difference between weathering a storm and going under.