The evolution of technology is driving transformation for countless industries, and finance is no exception.

Rapidly-advancing technologies such as robotic process automation and artificial intelligence are vastly improving internal and customer-facing business processes and communications related to finance, in addition to creating a considerable supply of useful data.

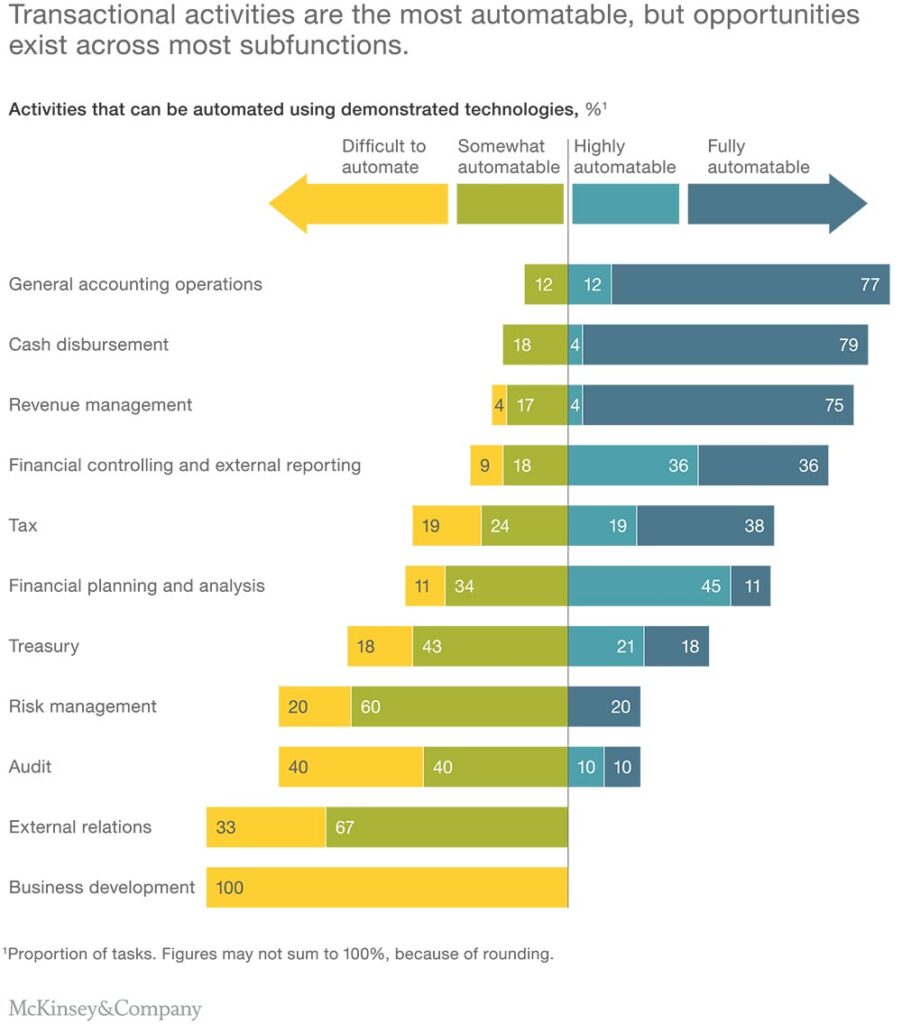

According to a report from McKinsey & Company, more than 40% of finance activities can now be fully automated. This includes activities such as cash disbursement, revenue management, recurring billing, and general accounting. And another 19 percent of financial activities can be mostly automated.

As a result, the skills and capabilities needed to be an effective finance professional are changing. CFOs and finance teams are facing increasingly blurred and newly emerging responsibilities. Some finance roles may be entirely replaced by automation and artificial intelligence (AI). Other roles will require finance professionals to evolve their skills to get the most out of technology innovations, thus enabling them to remain competitive and continue adding value to their business.

Fully embracing digital transformation will allow finance teams to reduce their process costs substantially and redeploy talent to other value-added activities.

How quickly are companies adopting automation technologies?

Surprisingly, businesses tend to be slow to adopt new finance automation tools and technologies. Only 13% of CFOs and senior business executives said their finance organizations are using them, according to a recent study. And only 5% said they’re seeing a return on their investment.

The lag in adoption and effective implementation is largely due to a lack of understanding and education with regard to these technological advances. Many CFOs are unaware of what’s currently available to them. And those who are taking steps to automate and evolve their processes often aren’t aware of how to take full advantage and get the optimal value out of the technology.

Siloed business departments and a lack of tech skill sets are additional reasons why businesses aren’t edging forward and seeing the full benefits of advancements in financial technology. The level of open communication and technology know-how simply haven’t kept pace with what this newly-evolved space requires.

But pleading ignorance is no longer acceptable; nor is a reluctance to restructure or retrain. CFOs and financial teams that fail to implement and fully employ new technology solutions are missing opportunities to be better, faster and more innovative for their organizations. And while the gap between businesses that are evolving in terms of financial tech adoption and those that aren’t may not be huge today, that won’t be the case for long.

What can automation and finance technologies do for a business?

An adaptive billing solution is a key example of a business’s new digital tech arsenal. These responsive platforms enable finance departments—and subsequently entire businesses—to be more agile, and to be better positioned to capture greater value.

Case in point, these types of billing systems offer businesses the simple, seamless technology to update their catalogs and pricing in real time. This ensures the ability to evolve products and services and create new offers as the market and competition demands, directly impacting time-to-revenue.

The automation technologies offered by intelligent billing platforms can also bring a lot of value with regard to reducing costs, which is going to be a top priority for businesses in the coming years, according to research by The Hackett Group.

Businesses with legacy billing systems often expend a lot of human hours doing manual billing and follow up.

By adopting a dynamic billing system, businesses can fully automate their entire billing process, deploy automated follow-up emails as necessary, and perform a number of detailed dunning management tasks to eliminate revenue leakage. Examples include notifications of looming credit card expiries, automatic retries on declined cards, and automated payment reminders to customers.

Consider Instream, a B2B SaaS business that provides tools and services to the dental community and insurers. Instream’s previous system involved manually entering, tracking and billing its subscription customers. However, this labor-intensive, process-heavy system became unmanageable as the business grew.

Since moving on to a responsive billing platform, the business has cut its efforts by 80% and can register and invoice its customers in a fraction of the time. Billing automation technology has cut costs for Instream by reducing its manual work as well as by eliminating the need to increase its human resources as the business scales.

The hours automated billing systems free up for businesses like Instream also enables their human talent to evolve their skillsets and focus their efforts in more productive and strategic ways beyond standard task and data management. The benefits extend to the ease of meeting important compliance requirements like revenue recognition.

The crucial role of data in the evolving finance landscape

Access to comprehensive analytical data is another way technology is evolving the finance landscape, as well as the roles of financial professionals. Automated processes and AI capabilities are continually generating data and equipping CFOs and their finance teams with significant amounts of business intelligence.

The flood of data—and the deep insights it provides—can be used to not only guide the development of business strategies but also to empower finance teams to lead the implementation of these strategies across all business departments.

Going well beyond the purview of measuring and reporting on business performance, the roles of finance professionals are evolving. From ‘finance chief’ to the ‘natural owner of Big Data,’ the CFO’s role is expanding and shifting to a wider scope of responsibility. CFOs and their finance teams need to embrace these shifts and foster open, business-wide communication and collaboration.

Evolving your team along with your technology

CFOs will need to become savvy and strategic when it comes to implementing the right technologies at the right time to meet their business objectives. They’ll also need to play a role in tearing down siloes to encourage a more seamless flow of information across all business departments.

This transformation includes championing a culture of growth and change, and likely redefining the roles of various team members. As mentioned at the outset, tech, automation, and AI will likely alter certain roles and makes others obsolete. Providing training and finding new ways to direct talent will be a necessary evolution.

CFOs and finance leaders will also need to develop the skills to coach others—both within and outside of the financial team—on innovative approaches for using new digital tools and data to create value for the business.

The time to evolve is now

As businesses continue looking for every possible competitive advantage, the area of finance can no longer be overlooked or left to lag. Finance departments need to acknowledge, adopt, and even get in front of the evolving financial technology (fintech) space.

New technologies, automation, and AI capabilities now available can create efficiencies, cut costs, and enable businesses to put their finance professionals to work in more useful and creative ways than ever before. And as a result, business finance, and the roles of finance professionals, are being radically transformed and disrupted.

The CFO of this digital age will need to act as a champion of the tech transformations taking place, providing guidance on strategy and leadership as well as technical expertise.

These individuals and their teams will need to build on their essential finance skills with evolving technologies and the useful information they offer.

They’ll also need to act as data-driven decision hubs with the ability to guide their businesses to make informed decisions and develop innovative ways to find value across all departments.

Both creativity and calculated risk-taking will play a big role in how successful financial professionals will be at adapting, evolving their careers and leveraging intelligent digital solutions to guide businesses into the future.