Try as hard as you might, but not all SaaS customers will stay with your business for the long term.

Some customers will start to grow in different directions and will no longer need your product. And others will go through budgetary adjustments—or may even go bust.

When churn situations like these occur, having to end the customer relationship can be disappointing, but inevitable.

On the flip side, experiencing passive or involuntary churn can be a lot more frustrating than disappointing.

After all, a customer may have genuinely intended to continue their subscription—only to be unceremoniously pushed out of your platform because its payment failed to go through.

In fact, they might not have even realized the situation until it was too late. And making the effort to get back into good standing? Sometimes, it can prove to be too much.

Involuntary churn is painful—not just for you as your business leaks revenue, but also for your customers as their users miss out on accessing the value of your product.

The good news?

Getting serious about your business’s dunning management process can do wonders for preventing that oh-so-frustrating involuntary churn.

Try comparing your current dunning efforts against the four strategies below for recovering failed payments.

- Is your SaaS business well equipped to maintain a high payment collections rate, or

- is it doomed to continue losing customers to churn?

1. Leverage Credit Card Auto-Updating to Keep Your Customers’ Payment Information Up to Date.

Nearly half of churn occurs due to payment card failures.

What this means is that if you work on reducing your payment card failure rate, you can potentially stop a lot of customers from churning out.

Payments fail for a variety of reasons. Maybe the credit card was temporarily maxed out or the payment was blocked.

In these situations, you may need to inform the customer of the payment failure (more on this shortly!) and request a different payment method.

On the other hand, their credit card could have just expired. Fortunately, the problem of expiring cards can easily be resolved—and without bugging your customer.

How? By choosing a payment processor that leverages credit card auto-updating.

When you do so, you can receive information from credit card issuers to automatically update any customers’ expiring card details. Many modern payment processors will have this feature built-in. Make sure yours does.

The auto-update will happen in the background and help make payment collection uneventful but ultimately a success—which is what you want.

2. Implement Automatic Payment Card Retries.

Imagine you’ve just finished a delicious meal at a restaurant. You head to the counter to settle the bill and hand the staff your credit card. Unfortunately, the card is declined. But before you start offering to wash the dishes, you’d probably ask the staff to retry the card.

So likewise: if, at first, a SaaS payment doesn’t succeed, then try, try again!

After all, while automatic credit card updating can save a good number of payments from failing, this method isn’t foolproof.

You can’t be manually retrying all failed credit cards, though. That would take up way too much time.

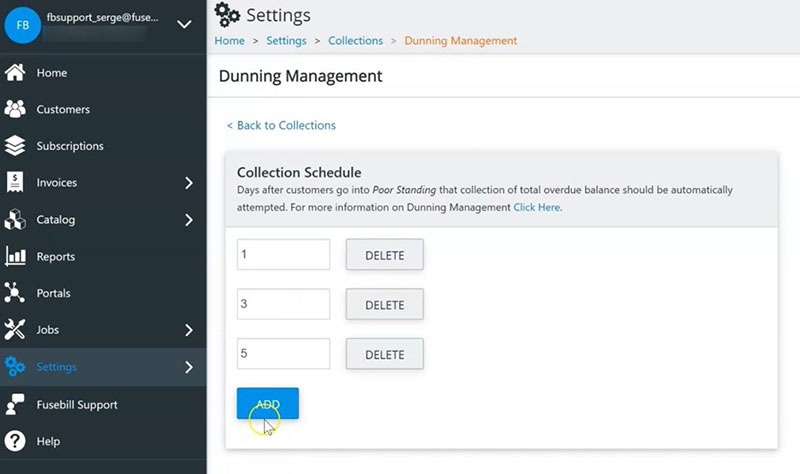

The more efficient solution is to tap on a modern subscription management software that automatically retries credit cards according to a preset retry schedule.

As an example, you could retry credit cards one, three, and five days after the initial failure.

Using such automated dunning management processes, for instance, backend-as-a-service business bitHeads was able to recover 5–10% of its monthly revenue.

3. Send Automated Messages to Encourage Customers to Rectify a Failed Payment Issue.

Automatic credit card retries not working? Get in touch with the customer to let them know what’s up.

If your customer intends to renew, then this can help in salvaging the situation before its subscription is canceled.

Your subscription billing system will need to be able to send automated dunning emails and/or text messages that:

- politely inform customers about the failed payment: keep things friendly—you don’t want to alienate your customer;

- induce a sense of urgency to take action: for example, gently remind your customers of what they stand to lose if their subscription is canceled; and

- empower customers to rectify the issue: such as by linking to a self-service portal where they can conveniently update their credit card details.

Similar to credit card retries, you shouldn’t stop at sending only one dunning email or text message.

Follow up a couple of times, so your customer is more likely to remember and take action on the failed payment.

Sending dunning messages as persistently as 30 days after the failed payment can be effective in boosting collections. But at some point, you may need to take matters into human hands.

This brings us to the next strategy…

4. Identify Severely Delinquent Customers and Follow Up With Them Personally.

Even the best automated dunning process doesn’t have a 100% success rate. Instead, your automated system may get drawn into a battle of wills with the customer, while its account receivable continues to age…and age…and age.

In its U.S. Accounts Receivable and Days Sales Outstanding Industry Report for Q2 2021, for example, business consultant Dun & Bradstreet estimated that:

- 1.4% of aging dollars for businesses in the prepackaged software services industry are 60 to 90 days late, while

- 6.3% of the same are more than 90 days late.

Going after such severely delinquent customers requires a more hands-on approach: it’s time to dispatch your billing clerks to reach out to them personally.

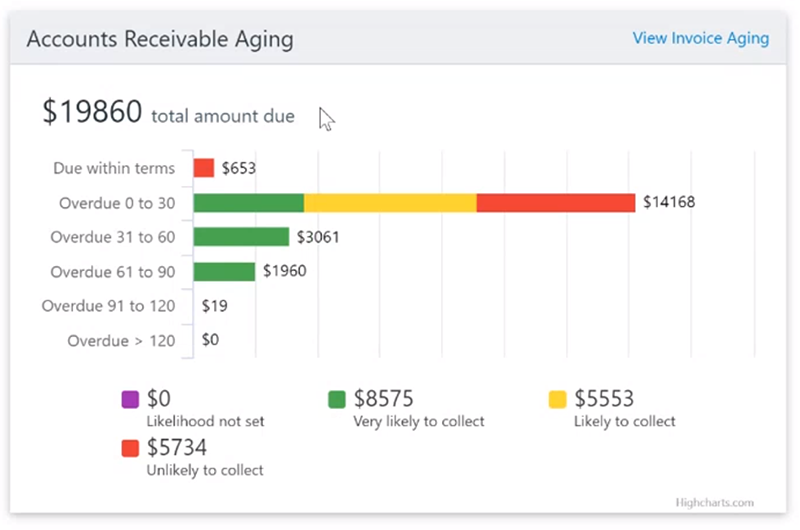

But first, you need to be able to identify these customers—and this calls for using modern billing software that can help you comprehensively track and manage your aging accounts receivable.

Don’t let any failed payment slip through the cracks when there’s still a chance of recovering it!

Your billing system should give you a bird’s-eye view of all outstanding accounts receivable, including which customers are owing, how much they owe, and by how long.

It should allow you to drill down into aging accounts receivable for specific customers, and:

- assign likelihood ratings to aging accounts receivable that have a greater prospect of being collected on,

- provide a visual update you can easily review at a glance, and

- save notes on interactions with delinquent customers to facilitate seamless collaboration among your billing clerks.

Reviewing all these records, your billing clerks can then make an informed decision on whether to continue expending resources to recover payment or to write off the problematic invoices and move on.

Reduce Payment Failures and Churn with Digitally Transformed Dunning Management

While never welcome, instances of involuntary churn can uncover cracks in your recurring billing processes that are causing you to leak revenue.

Take such discoveries as an opportunity to digitally transform your SaaS business operations and reduce failed payments and churn.

The right automated billing system can help ensure your dunning management efforts kick in at the moment a customer’s payment fails—and not only when a billing clerk realizes an invoice has been unpaid for days or even weeks.

Then, with these automated processes handling most of the heavy lifting, your billing clerks will be free to focus on the most stubborn of delinquent payments.

And hopefully, there will be very few of these!

If losing customers to failed payments makes your stomach churn (pun absolutely intended), then a modern recurring billing platform powered by all the features designed to maximize collections and customer retention provides the crucial antidote.

Quick FAQs about Dunning Management

Q: What is Dunning Management in SaaS?

Dunning management in SaaS is the process of dealing with failed and declined credit card payments to recover lost revenue. It helps in proactively managing customer accounts to ensure consistent revenue growth and long-term success.

Q: Why is Dunning Management essential for a SaaS business?

Dunning Management is crucial for a SaaS business as it helps prevent involuntary churn due to payment failures. It also allows businesses to identify and address cracks in their recurring billing processes that may be causing revenue leakage.

Q: What are some common reasons for payment failures in SaaS?

Payment failures in SaaS can occur due to a variety of reasons such as credit card expiration, temporary maxing out of the credit card, or blockage of the payment.

Q: How can I reduce the rate of payment card failure?

You can reduce the rate of payment card failure by choosing a payment processor that includes credit card auto-updating, informing customers about the payment failure and requesting alternate payment methods, and using automated dunning management processes for retrying credit card payments.

Q: What steps can be taken when auto-retries of credit card payments fail?

If auto-retries of credit card payments fail, businesses can get in touch with the customer, inform them about the failed payment, and induce a sense of urgency to rectify the issue. Businesses can also provide a self-service portal for customers to update their credit card details conveniently.

Q: What is the role of a billing system in Dunning Management?

A modern billing system plays a crucial role in dunning management. It can provide a comprehensive view of all outstanding accounts receivable, track and manage aging accounts, assign likelihood ratings to receivables with a higher prospect of collection, and facilitate collaboration among billing clerks.

Q: How can SaaS businesses handle severely delinquent customers?

For severely delinquent customers, businesses need a more hands-on approach. Billing clerks can reach out to such customers personally. The billing system should help identify these customers and provide all necessary information about their outstanding accounts.

Q: How can Dunning Management contribute to reducing churn in SaaS businesses?

Dunning Management can help reduce churn in SaaS businesses by proactively managing customer accounts, preventing billing disruptions, and recovering failed payments. It can also help in identifying and fixing issues in the recurring billing process that may be causing involuntary churn.

Q: What are some features of a modern recurring billing platform that can help in Dunning Management?

Modern recurring billing platforms can offer features like automated retry schedules for failed payments, automated dunning emails or text messages, comprehensive tracking of aging accounts receivable, and a self-service portal for customers to update their credit card details.

Q: What strategies can SaaS businesses employ to recover failed payments?

SaaS businesses can employ strategies like auto-updating of credit card details, automated retry of failed payments, sending automated dunning messages to customers, and taking a hands-on approach with severely delinquent customers to recover failed payments.