The growth of subscription eCommerce is undeniable: businesses are increasingly offering products and services through subscription models, as opposed to one-time transactions. In fact, by 2026, the global eCommerce subscription market is projected to reach over $900 billion. Even those which haven’t completely converted to subscription business now offer multiple purchase options.

As long as SaaS business and hybrid business models continue to enable customers to enjoy flexibility and convenience, businesses will continue benefiting from recurring revenue, which means subscription-based companies likely are here to stay. This evolution in revenue collection, however, also requires a different long-term approach towards billing for growing businesses. While it can provide many opportunities for businesses looking to scale, it can also introduce some complexities from a billing perspective.

. This is where the necessity for a robust billing system comes into play—one that can act as your business’ financial system of record (SOR). In this article, we will dive into the necessity of having a robust system of record, how billing systems can help with data management, and why adaptive billing systems are the superior choice for long-term, sustainable growth.

TL;DR

- A finance SOR is a data warehouse for all banking and financial transactions and operations, and plays a critical role in data storage and management for not only financial records, but data like customer account details. It can be used for various purposes, including aligning with regulatory standards, financial audits, tax management, and accounts payable and receivable. An example of a finance system of record can be an adaptive billing system.

- Adaptive billing systems are integrated with a business’ existing technologies to enable this seamless communication between departments, processes, and strategic business objectives. When a business lacks a singular financial system of record feeding into its billing—the kind that an adaptive billing system can provide—it lacks a 360-degree view of the process.

- Regardless of the size or sector of your recurring revenue business, the inflexibility and disconnect of an outdated billing system can be a barrier to growth.

What is a (finance) system of record?

Broadly speaking, a system of record functions as an information storage system that houses data that’s critical to the continued function of the business or organization. This can be stored physically and on-location, but can also be stored on a remote server in the cloud. While the precise purpose of an SOR varies from industry to industry, a system of record essentially stores proprietary company data that is crucial for certain key business processes.

Types of systems of record

While the focus here is on finance SORs, do note that there are different types of systems of records. For example, a human resources SOR could be used as a repository on employee data like salaries or hard and soft skills, and could help the HR team with tasks such as talent acquisition, payroll administration, onboarding and/or offboarding, and employee engagement.

Meanwhile, an IT SOR could be used for developing, testing, and debugging new applications; streamlining the IT workflow; automating manual tasks; security operations; and other tasks. No matter the sector, a system of record aims to help with centralization, efficiency, and automation, particularly when dealing with large amounts of data.

Onto the systems of record we’re most interested in: a finance SOR is a centralized platform that functions as an authoritative data source or information system for financial transactions of a company. The emphasis on this definition here lies on the keyword “authoritative”: a finance SOR, in theory, provides the definitive answer on a transaction should there be a disagreement or discrepancy between other systems or parties, basically functioning as a unified set of values or the backbone of the company.

What is a finance system of record?

A finance SOR is a data warehouse for all banking and financial transactions and operations and plays a critical role in data validation, storage, and management. This is done not only by financial records, but also data like customer account details, all of which may be used for various purposes, including aligning with regulatory standards, financial audits, tax management, and accounts payable and receivable.

A finance SOR is especially important should your finances be reliant on multiple integrations, databases, or programs: as the overarching and leading system, the data in this SOR should be viewed as the master data. The system of record can also centralize various business processes like treasury management and financial analyses into one integrated system, providing a clearer and more granular overview into your organization’s financial health.

Benefits of Having a Finance System of Records

Although we have touched on some of the advantages of having a finance system of storage above, below is a high-level summary of these benefits:

- Automation: SOR software can often automate rote tasks related to invoicing or credit card payments, but can also offer real-time alerts for certain event triggers, freeing up employees’ valuable time to focus on more pressing issues.

- Improved compliance: A structured data approach makes compliance a much easier process, especially as ensuring regulatory compliance and adherence to financial standards becomes increasingly strict. With a finance SOR, ASC 606 compliance and accurate financial reporting can be significantly streamlined.

- Security: With a centralized system of records, it can be more cost-effective to focus on securing only one central repository as opposed to having multiple security protocols for a disparate network, ensuring industry-leading security infrastructure.

- Collaboration: With a single source of truth (or SSOT), it becomes easier for colleagues (or even external stakeholders) to access information in real-time and always ensure that they are working with the latest, most up-to-date information, which can also lead to significant efficiency gains.

One thing is certain when looking at a finance SOR: it’s all about data integrity and management. Let’s look at a real-life example to better understand how systems of records can be used for parsing data and making data-driven decisions.

Managing Abundant Data

Recurring revenue-based businesses can create a lot of data. This data pours in continuously from across all business processes, and it has to be managed, tracked, utilized, and reported on as needed.

Consider Zendesk—a Software as a Service (SaaS) business offering a customer service and engagement platform. Its clients are able to create their own custom solutions with Zendesk’s products, apps, and customer relationship management integrations. Alternatively, they can go with the business’ bundled suite of software products.

Zendesk collects its clients’ data, including their choices of products, apps, integrations, and payment information. Both the custom and bundled options are available on a month-to-month or annual basis, and clients can add to their core plan with additional features as needed. Each of these comes at a different price point per user. All of this paired with the clients’ ability to build up or reduce their plan at any time creates many layers of complex data to be tracked.

Zendesk needs to be able to use its data to deliver its products, apps, and integrations seamlessly, as well as deliver its billing with accuracy and transparency. It also likely makes use of its breadth of data for numerous other functions, from marketing and sales to pricing, customer service, financial reporting, and more.

Many recurring revenue businesses operating on legacy billing systems struggle to collect, manage, and make use of a comprehensive set of data like this. Instead, bits of required information from various areas of these businesses are stored in multiple systems, and this information can often be difficult to stitch together in a meaningful way.

Alternatively, they may have the same data available on multiple systems, but the values of that data sometimes differ. In these cases, it can be challenging if not impossible to determine which is accurate—a situation that quickly becomes a serious liability.

A fractured, outdated legacy billing system like this would undoubtedly lead to a range of problems, such as incorrect or missed bills, disrupted or unpredictable access to services, and ultimately unsatisfied customers.

How an adaptive billing system can help

An adaptive billing system can consolidate and safely manage all the data from a recurring revenue business in one place, acting as a financial source system of record. If done well, it can also act as a single source of truth for:

- Customer service

- Contract management

- Sales

- Quotation systems

- Entitlement administration

Having a SSOT ensures that when your business’ customer service and sales representatives are working with your clients, the data they’re using is uniform and accurate. There’s nothing more frustrating from a client perspective than playing a game of “he said-she said” between reps with conflicting data. Consistency is key.

For sales and quotation purposes, a SSOT ensures prospective clients are being shown the most accurate and up-to-date offerings and prices. This eliminates any confusion for both the internal team and prospective customers.

In fact, a business’ billing system is often its only reliable source of product catalog, customer hierarchies, and most current pricing data. Accuracy in these areas is imperative for correctly and consistently delivering products/services, billing, and appropriate customer care—not to mention following up with detailed reporting on the back end.

As an authoritative data source, aSSOT also ensures that everyone on your team is performing tasks and making important business decisions based on the same data set and group of records. This is critical both for internal and external stakeholders, as data from multiple silos across departments instead of one accurate, central source can lead to costly errors that impact everything from sales to customer service, compliance, audit, and ultimately profits.

By establishing this hub of reliable, easy-to-access information, a business is in a better position to perform on a daily basis, as well as reach its long-term acquisition and retention goals.

What is an adaptive billing system?

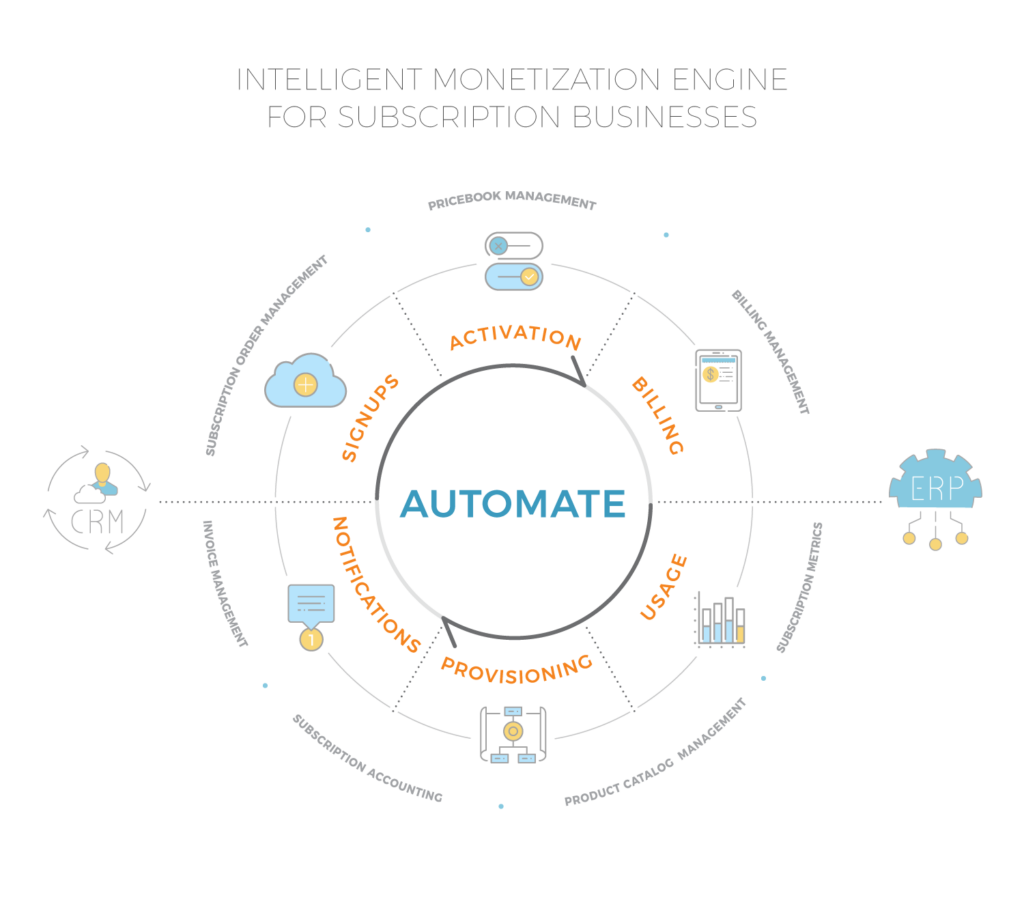

Billing used to be a very disconnected, back-office element of conducting business. Today, the e-commerce landscape involves deep digitization of business processes and is consumer-driven in nature. There’s a need for billing to communicate with all areas of a business.

Typically cloud-based, adaptive billing systems are integrated with a business’ existing technologies to enable this seamless communication between departments, processes, and strategic business objectives. For example, customer-facing sales systems communicate with back-end systems such as fulfillment, payment, reporting, and more. All of these link with a business’ key objectives, such as increased profit margins, growth in market share, or improved customer service.

Adaptive billing systems are also deeply integrated with a business’ financials, e-commerce, order management, and provisioning systems. Data is fed from the billing solution into the full business process from beginning to end. This data connects with vital systems along the way, improving a business’ accuracy and capabilities with regard to general ledger, revenue recognition, financial close, reporting, forecasting, and more.

Among these, revenue recognition is especially important for subscription-based business’s workflows. For them, getting out of sync with revenue recognition can lead to restating revenue and potential legal ramifications.

The level of robust integration involved in adaptive billing systems would have taken an exorbitant amount of time and money to achieve in the past. However, technological advances and automation have made the process more streamlined, less costly, and more effective on a granular level.

Once in place, these systems use their data connections to create profitable efficiencies and reduce revenue leakage. Agile billing systems eliminate time-consuming manual work—and inevitable human errors—by automating a number of billing-related tasks. These include invoicing, email notifications, and credit card payment failure retries.

Additionally, because an agile billing system integrates with a business’ other technologies, opportunities for evolving to meet market demand are more visible. It becomes easier for team members to jump on these opportunities without delay.

Adaptive billing systems are fundamental to agile monetization

There are opportunities for monetization across an entire business, from product/service development, to marketing, sales, billing, and even customer management and support. Agile monetization means being able to see these opportunities presented through internal data and external market demand, and quickly convert these into revenues, profits, and competitive edge.

An adaptive billing system is key to agile monetization.

As the system of record, it can quickly and accurately pull together data from across an entire business to accomplish robust reporting and forecasting. Additionally, these billing systems provide a modern, intuitive user experience that even multiple stand-alone billing applications could never duplicate.

On a financial level, a sleek and flexible user experience enables businesses to accomplish all of their pricing and billing tasks quickly, easily, and without the continual and often expensive involvement of tech support. On a broader level it enables businesses to rapidly create and implement new offerings and pricing strategies in line with market demand—and evolve old ones as necessary—to convert opportunities to revenue.

Does my business need an adaptive billing solution?

Regardless of the size or sector of your recurring revenue business, the inflexibility and disconnect of an outdated billing system can be a barrier to growth.

It’s always better to be proactive than reactive. Many businesses begin to see an adaptive billing solution as imperative when they start straining to keep up with their competition in terms of time-to-revenue, and struggling to complete basic financial functions accurately. Invoicing is a good example of this.

Even if a recurring revenue business doesn’t interact with its customers frequently, they do send regular invoices.

With each invoice sent, a business has the opportunity to create a positive impression on a customer, or a negative one.

Customers will critique your business based on a variety of factors, including the accuracy of your bills, how closely the services you provide match your original agreement, the readability and level of detail included in your invoices, and more. These critiques form the opinions and dialogues your customers will have about your business, which affects your customer retention, your reputation, and your chances of long-term success.

A competitive prerequisite

When a business lacks a singular financial system of record feeding into its billing—the kind that an adaptive billing system can provide—it lacks a 360-degree view of the process. Data errors can easily begin to crop up.

Errors in billing and reporting can lead to billing disputes, dissatisfied customers, and revenue leakage, not to mention compliance issues and the resulting trouble when it comes to auditing.

Inaccurate data can also lead a business to make uninformed decisions based on incorrect customer purchase information and forecasted revenue.

Acting as the financial system of record for your business, an adaptive billing system provides the data and functionality to ensure your business’ processes are accurate, transparent, reliable, and cutting-edge—traits that make it easy for your customers to keep coming back for more.

Of course, the seamlessly integrated nature of an adaptive billing system also frees your recurring revenue business from the limitations of a legacy system. This makes it easier to scale the business as new opportunities present themselves.

Quick FAQs about Financial System of Record

Q: What is a Financial System of Record (SOR)?

A Financial System of Record (SOR) is a centralized platform that serves as an authoritative data source for an organization’s financial transactions. It acts as a data warehouse for all banking and financial transactions and operations and plays a critical role in data storage, validation, and management.

Q: How can a billing system be used as a Financial SOR?

A robust billing system can function as a Financial SOR by consolidating and managing all data related to financial transactions in one place. This includes customer account details, payment information, and transaction history. It ensures the accuracy, transparency, and reliability of business processes.

Q: What are the benefits of using an adaptive billing system as a Financial SOR?

An adaptive billing system as a Financial SOR offers several advantages such as data integrity and management, automation of routine tasks, improved regulatory compliance, enhanced security through centralized data storage, improved collaboration with a single source of truth (SSOT), and the ability to scale with business growth.

Q: What is the difference between a System of Record (SoR) and a System of Truth?

A System of Record (SoR) is an authoritative source for a specific type of data within an organization, while a System of Truth encompasses a broader scope, often integrating and verifying data from multiple systems of record. The system of truth aims to provide a holistic and accurate view of data across different sources.

Q: What role does an adaptive billing system play in agile monetization?

An adaptive billing system, as the system of record, plays a key role in agile monetization by pulling together data from across the business for robust reporting, forecasting, and decision-making. It enables businesses to identify revenue generation opportunities across different processes and quickly convert these into revenues, profits, and competitive edge.

Q: What is the system of record standard?

The system of record standard refers to the established protocols and policies an organization follows to ensure its system of record maintains data integrity, security, and accessibility. This often involves regular audits, adherence to industry-specific regulations, and strict data entry and management practices.

Q: How does an outdated billing system impact a subscription-based business?

Outdated billing systems can create barriers to growth for subscription-based businesses. They often struggle to collect, manage, and make use of comprehensive data. This can lead to data errors, billing disputes, revenue leakage, compliance issues, and inaccurate forecasting, all of which can negatively impact the business’s reputation and long-term success.

Q: Why is a single source of truth (SSOT) important in a billing system?

A SSOT ensures consistency and accuracy of data for internal team members as well as clients. This eliminates confusion and ensures prospective clients are shown the most accurate and up-to-date offerings and prices. It also ensures that customer service and sales representatives are working with uniform and accurate data, enhancing the customer experience.

Q: What is the role of an adaptive billing system in a recurring revenue business?

An adaptive billing system consolidates and manages all the data from a recurring revenue business in one place, acting as a financial source system of record. It ensures that when customer service and sales representatives are working with clients, the data they’re using is uniform and accurate. It also ensures prospective clients are shown the most accurate and up-to-date offerings and prices.

Q: How does an adaptive billing system contribute to a business’s long-term acquisition and retention goals?

By establishing a hub of reliable, easy-to-access information, an adaptive billing system puts a business in a better position to perform daily tasks, as well as reach its long-term acquisition and retention goals. Its integrated nature frees the business from the limitations of a legacy system, making it easier to scale as new opportunities arise.