In the early days of a subscription business, everyone does a little bit of everything. A single person might oversee marketing and sales, while another takes care of accounting and billing. Every team member, of course, is also personally invested in providing a quality product.

But as a business scales, this start-up-style structure becomes impossible to maintain.

Such was the case with Uberflip—a business-to-business, software as a service (B2B SaaS) company that provides content marketing services. Uberflip built its own internal billing and payment system when it first started out, but then outgrew it as the business scaled.

Thankfully, implementing scalable subscription billing automation software solved the problem. Since automating, Uberflip has reduced billing time from one week down to one day. This means the company now has about 40 more hours a month to focus on providing the best possible service to its customers—rather than focusing on billing them.

So how can your business reclaim these hours as well, and how else do SaaS businesses benefit from this type of software?

Read on for five ways automation saves substantial time and resources so businesses like yours can put greater focus on core objectives.

1. Automates subscription billing, invoicing, and payment

Obviously, subscription billing software automates tasks associated with billing, invoicing, and payment. But, it’s important to understand how this happens and what it looks like.

An agile recurring billing platform should integrate seamlessly with your existing business software—like Salesforce, NetSuite, HubSpot, and QuickBooks—as well as your payment gateway. This ensures your business is working from a single source of data.

We’ll dig more into this shortly.

With your data synchronized, your billing software can use information from your customer relationship management (CRM) system—or other business management platform—along with customers’ specific plan information to automatically, and accurately, bill and even collect payment.

And, with the right billing solution, customers new and old can easily access a self-service portal to view and update their own profile and billing information to maintain the most accurate data. Eliminating the manual tasks from this entire process can save your team a ton a time.

For example, dental and insurance B2B SaaS business Instream reduced billing time by 80% after automating its billing. By switching from manual registration of new customers via faxed or scanned forms to an integrated platform with a self-service customer portal, Instream is now more operationally efficient and user-friendly.

2. Acts as a single source of truth (SSOT) for revenue operations

As mentioned, because subscription billing automation software integrates with CRM, accounting, business management tools, and payment gateways, they quickly become a reliable, single source of truth (SSOT) for accounts receivable.

As data management provider Talend notes, “Far too many companies struggle with data-related issues such as organizing multiple sources of data, a lack of collaboration between teams, low data accuracy, and poor data accessibility.”

Integrated subscription billing means team members don’t have to search in multiple places for correct, current data.

With everything in one place, everyone has access to the same information, streamlining operations—thus eliminating unnecessary and duplicated efforts. An SSOT also comes in handy when it comes to accounting, taxes, and revenue recognition.

3. Automates dunning management

What if a payment fails? This is where truly comprehensive subscription billing automation software stands out from the competition. Failed payments are not only a headache for your finance team, but they can also lead to churn, which kills revenue.

The dunning management capabilities available in these platforms actively work to not only prevent failed payments before they happen, but also immediately rectify any that do.

Dunning management is a balancing act, and in order to optimize the process, three main components need to be in place.

- First, businesses should retry failed payments before reaching out to customers.

- Second, when it comes time to reach out to the customer, communication must be informative but not overly aggressive.

- Lastly, customers need an easy way to update their own payment information as necessary.

When handled manually, all of this takes up precious time and resources—something marketing provider On The Map knows all too well.

On The Map implemented a simple billing platform as its business scaled. However, the platform fell short, lacking automated dunning management capabilities. This left the business’s team members to follow up manually with failed payments from expired or underfunded cards.

After switching to more intelligent automated billing software, dunning management has become an efficient background process. It quietly works away at failed payments and churn—automatically notifying customers before their cards expire, giving them easy access to update their payment methods, retrying failed payments on a preset schedule, and following up with automatic email communications every step of the way—while the team focuses on other core business objectives.

4. Streamlines subscription billing management

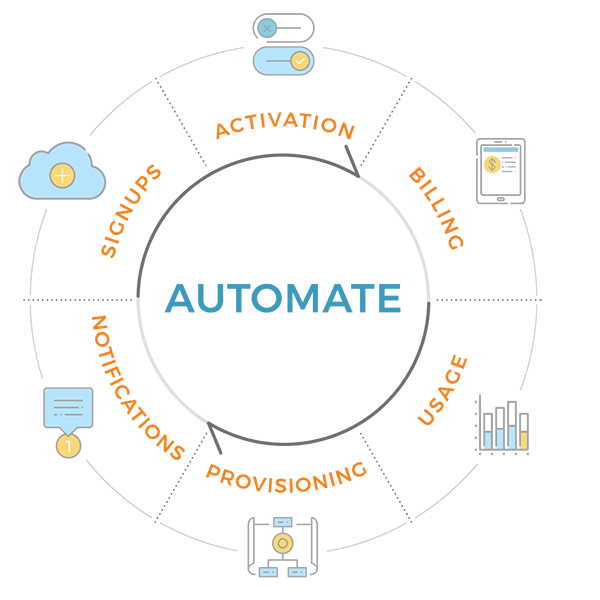

Dunning isn’t the only management agile subscription billing software provides. It also offers automation and insight at every step of the billing process, from signup to provisioning, and even churn.

With an intelligent platform, each step of this process is streamlined and optimized. Among the many other benefits, customer success management (CSM) becomes easier.

Acting as a SSOT, subscription billing platforms use abundant data to track and report on subscriber metrics. These metrics—accessible by all team members—are tremendously helpful for CSM.

Trends in customer retention and churn help CSM teams identify when and why customers stay or leave. For example, tracking and reporting by customer cohorts can enable your business to see how certain similar groups of customers are contributing to your sales.

You can monitor and compare sales versus customer churn rate among cohorts, and use any noticeable trends to proactively take action against future churn.

Subscription billing platforms also offer great insight and reporting functionality on financial metrics, including sales, cash, revenue and monthly recurring revenue (MRR). Each of these pillar metrics will tell you something different about the health of your business. And exploring them on a more granular level will enable you to project your business’s future health, as well as make more strategic decisions.

When customer success and retention are high, businesses thrive. And when businesses are aware of their full financial picture, they can plan for a scalable future. Automated billing management makes all of this possible.

5. Provides greater accuracy, freeing up time and resources

Finally, automation means fewer mistakes due to human error. As a business scales, relying on manually inputting customer subscription and payment information, and then manually billing based on that data, leaves a lot of room for mistakes. Add to this the pressure of being short on time, and the errors can quickly accumulate and create a costly problem.

Missed or incorrect invoices, involuntary churn due to payment complications, and a decrease in customer trust and satisfaction can bring a business to its knees.

Automated subscription billing helps eradicate these issues. It also frees up valuable time for team members who were previously dedicated mostly, if not completely, to billing.

Spend more time on business, less time on billing

When your business’s customer-count rises high enough to put a strain on your billing and invoicing, it’s time for a change. Rather than burdening resources with easily automated tasks, businesses can free up time and energy to better leverage their team’s talent and skill sets. This shifts core business objectives to where they belong: in center focus.

A robust subscription billing platform like Stax Bill enables this automation, unlocking efficiency and reducing errors. It accomplishes this, all while providing a SSOT that streamlines revenue operations across department.

Stop wasting time on tedious, manual billing tasks. Refocus your team’s energy on your highest priorities with automation.