Sometimes, the easiest and most exciting part of starting a new business is finding a good niche. Bringing a business idea to reality, however, is a whole different story.

When a business goes from bootstrap to unicorn status in a short span of time, others take notice. What did they do right? What didn’t they do wrong? How did they avoid careening back to the beginning in a blazing display of social media review bombs and post-mortems?

Starry, an internet provider that soared to unicorn status last year, is one such example. Founded in 2014, the business supplies internet service for $50 a month with no caps or hidden fees. Now valued at more than $1.29 billion, Starry recently reported that it will be expanding its limited coverage to an estimated 40 million households in over 25 states.

The future certainly seems bright for Starry, and its customers.

But what happens when things don’t go according to plan, and your business starts to lose its momentum?

For example, consider the Wink Hub kerfuffle a few years ago. Wink’s hub is valued for bringing multiple smart products together, giving users more power to customize their products.

One day, the hub went lights out and disconnected from the internet. Suddenly, ‘smart’ houses were thrust back into the manual era. A quarter of Wink’s users were impacted by the outage, and some hubs were unable to be restored automatically, forcing customers to either put on their tech fix-it hat or wait for a replacement to come in the mail.

Once readily available via mainstream buying channels, Wink hubs are now slowly blinking out.

Growing your subscription business

In the business world, things can sometimes go wrong without much warning. Fortunately, with technology and cloud storage, there are many tools available to help when that happens. Unfortunately, there are also times when these tools are not fully utilized.

Take the recurring billing ecosystem, for example. The e-commerce and subscription billing world is growing to massive proportions, in two different pathways:

- new companies and entrepreneurs starting subscription businesses

- traditional companies transitioning to subscription offerings

It may seem like everybody is jumping onto the subscription billing bandwagon. However, many of those businesses court failure if they aren’t aligning their processes to the requirements of a successful subscription business.

Here are 6 practices that can impede growth in a subscription business:

1. Inflexible and unscalable manual subscription billing

In order to offer subscription options to customers, a business has to do it right. It isn’t just about finding a market need and filling it. A business must ensure that each recurring invoice is handled appropriately.

When businesses first open their doors, they may cut corners to minimize expenses. This often includes tracking their billing on Excel spreadsheets or with a billing system created in-house. A fast-growing business can quickly run into billing situations these systems can’t handle. If not managed appropriately, that can force a business to close its doors.

Some common problematic tasks include deploying new pricing structures or marketing tactics, or making bulk changes:

Pricing structures. What happens when a business wants to make changes to their pricing structure, but cannot due to an inflexible system? It will either need to engage the help of IT or software developers to make the change, or elect to leave their pricing as-is to avoid the problem.

Marketing tactics. One popular marketing tactic is using discounts or promotions to attract new customers and/or engage current ones. These features can help grow revenue, if employed correctly. However, if a business is tracking these changes manually, and has to ‘turn on’ a discount, it stands to lose significant revenue if that promotional price is not ‘turned off’ at the end of the period.

Bulk changes. There are instances when bulk changes need to be implemented, such as when production costs drive the product price higher. Without proper billing support, this can become a significant issue.

Fortunately, there is a solution that simplifies the billing process. It not only helps automate the recurring billing system, but even manages customers. A flexible recurring billing platform can help align and address many different components of the e-commerce industry.

Without a robust platform in place, a business opens itself up to complications. On The Map (OTM), a business that builds supercharged business websites, discovered that not only did tracking customer information with spreadsheets make billing increasingly difficult, but selecting the incorrect billing platform was just as problematic.

Automatically invoicing customers with Stax Bill has saved their accounting department 12 to 15 working hours per month.

As OTM’s CMO Kristaps Brencans said, “All the working hours we have saved thanks to Stax Bill has really given us the flexibility to keep on growing!”

2. Unsecured platforms which compromise data

Earlier this year, LabCorp disclosed that a data breach exposed the personal and financial data of 7.7 million customers, including social security numbers, credit cards, and bank numbers.

The breach did not capture the specific lab tests or results of those customers. However, it did compromise their names, birth dates, phone numbers, addresses, account balances, and dates of service.

The medical business immediately conducted an internal investigation, removed its payment page from the website, and moved their payment portal to a different third-party site.

Unfortunately, American Medical Collection Agency (AMCA), the billing collections agency responsible for the breach, was hacked prior to this incident. The breach was not limited to LabCorp customers, though. Quest Diagnostics also faced a breach with them that impacted 11.9 million of their patients.

On June 18, 2019, AMCA filed for Chapter 11 bankruptcy protection, seeking to liquidate its assets.

For recurring billing businesses, data breaches are a significant concern. If customer and billing information is not secure, they can face the same problem that LabCorp and Quest Diagnostics faced.

Modern recurring billing platforms take all necessary steps to protect customer data. Stax Bill, for example, is PCI Level 1 certified, meaning that it has gone through rigorous audits and customer data is secured behind the most advanced firewalls.

Businesses can join forces with recurring billing companies who maintain the most up-to-date security measures, knowing that their customer information will remain secure.

3. Incorrect revenue vs earnings tracking resulting in compliance problems

In 2017, software as a service (SaaS) giant Oracle released an article written by Steve Dalton. In it, Dalton outlined the steps businesses needed to take to prepare for the new revenue recognition standard changes, also known as ASC 606.

Within this standard, businesses are required to separate their finances into deferred and earned income. Recurring businesses, for example, often collect a payment at the beginning of a billing period, such as monthly subscriptions. However, they still owe their customer those services for the upcoming month. Consequently, they need to segment the payment day by day between deferred revenue or earned revenue.

Ironically, last fall, Oracle announced its quarterly earnings, only to re-release those earnings the next day, with a half-billion-dollar reduction. Talk about a financial double take.

Confusion or outright misinformation on financial statements undermine the integrity of a business at best. It can also have more costly consequences, such as being booted from NASDAQ’s list of common stock.

Regardless of the size of your business, revenue recognition is an essential part of subscription management. It is not an easy thing to track, as business giants like Johnson & Johnson and Boeing attested to when they were preparing for the revenue recognition changes.

Not only does a recurring billing business need to break income into deferred and earned segments, but customers can typically upgrade or downgrade their accounts at any time. How does that come into play with revenue recognition? Man-hours are wasted trying to work through all the moving parts.

Subscription businesses do not have to go at it alone. Automating subscriptions with recurring billing software streamlines the revenue recognition process, providing a Single Source of Truth (SSOT) based on accurate, current revenue data.

With reliable data, a business knows with complete certainty how much deferred revenue vs earnings it has from one day to another.

4. Improper subscription billing allowing for revenue leakage

Revenue leakage is an insidious drain on recurring revenue because it takes many different forms. Its holes can be small, slipping under the radar undetected. When they start to add up, however, businesses take a significant hit.

Vodafone Idea Cellular, the largest telecommunications operator in India, learned this the hard way. With a 28% drop in revenue between April and June 28, the business only stayed in the black by selling its telecom towers.

They needed to look for different ways to stop revenue leakage, and do so quickly. One solution they implemented was introducing a firewall to identify text messages sent undetected. The telecom giant had previously failed to charge for those messages.

Often, revenue leakage isn’t as easy to detect and solve. For example, a business offering agile pricing may not be able to efficiently monitor usage.

Robust recurring billing software modernizes the monetization ecosystem of subscription-based businesses by automating the billing process. With automation, businesses can create a set-it-and-forget-it system where pricing exceptions are handled instantly.

5. Ignoring critical communication in billing, impacting collections

Payments fail for many reasons, and businesses using a homegrown billing system often get mired down trying to manage those non-payments. What’s more, if a business doesn’t take steps to rectify the situation, the result is involuntary churn when an unpaid subscription is terminated.

One tried-and-true way to recover this leaking revenue is through dunning management—carefully worded messages sent to customers at specific times within a billing period. In our technologically-driven world, dunning emails are also ideal for alerting customers about a problem with their subscription, such as upcoming credit card expiries.

There are three major ways dunning management can work for your business:

Automatic retries of failed credit card payments recovers revenue.

Before a customer even knows that there is a payment issue, dunning management can retry their credit card. There is no exact science to determine when the best time is to retry a credit card payment; many recurring billing platforms have default retry days, such as day 1, 3, and 5 after the initial payment failure.

Declined credit cards result in an estimated $40 billion in lost revenue for e-commerce businesses. With automatic retries, businesses can recover this revenue before there is a break in services.

Dunning management improves communication with customers.

Business-constructed, automated dunning emails can address situations such as failed transactions. These messages can alert a customer that their payment method will be automatically retried, which has about a 75% success rate.

Dunning messages can notify a customer:

- how much is due

- the original payment due date

- what they will lose if the payment method is not updated

The communication should be worded in such a way that it does not offend the customer. After all, payments are not always declined due to a lack of funds. If a business incorrectly takes an aggressive stance in their communication, they run the risk of alienating a valuable customer who may churn out.

A subscription billing platform should allow a business to tailor messages to their needs, add their own branding, and set a schedule outlining when a specific email should be automatically sent.

Dunning management support allows customers to update payment methods themselves.

Eighty-one percent of customers want to resolve an issue independently, rather than reach out to customer service.

A simple way to allow customers to make changes to their payment method is by providing them with a Self Service Portal, or SSP. SSPs empower customers to make changes themselves, whether it is updating contact information, upgrading or downgrading a subscription, or updating their credit card to avoid subscription termination.

With an intelligent billing platform utilizing automated dunning management and other features, On The Map (OTM) recovered about $600,000 per year in revenue that would have been lost.

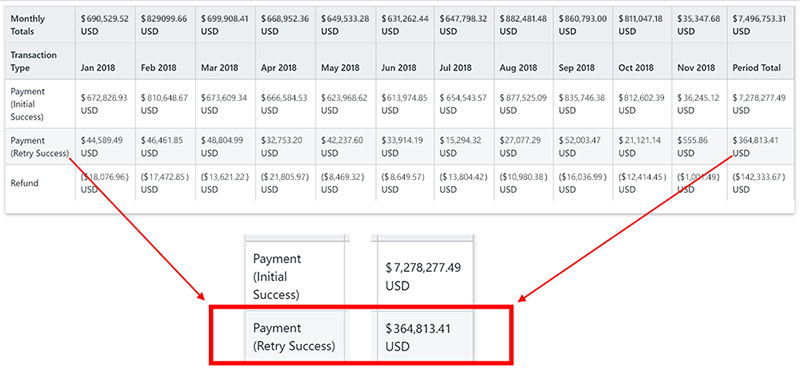

OTM isn’t an isolated case. Another business that automated their messages to customers through dunning emails realized that in the first 11 months alone of using Stax Bill, they recovered $364,813.41 out of a total of $7,278,277.49 in payments.

6. Complicated checkout processes leading to abandoned carts

AbandonAid is a marketing tool that circles back with a business’s potential customers. It reminds them that they left before completing a purchase, whether their cart was abandoned intentionally or unintentionally.

In an odd twist of fate, the business topped Baymard’s list of abandoned carts at 81.40% in 2017.

Why do customers decide not to finish a purchasing process they’ve started? There are many possible explanations, from shipping prices being too high to credit card declines. However, Baymard cites other reasons for abandoned carts. The checkout process being too complicated, for example, is the alleged cause of over 1 in 4 abandoned carts.

With a recurring billing platform, however, customers do not have to muddle their way through the checkout process. Such a platform streamlines the experience and reduces friction.

With multiple payment gateway options offered by select recurring billing platforms, cart abandonment rate can be further reduced. Baymard suggests that 6% of customers don’t finish the payment process because there were not enough payment options.

Automating your recurring billing obviously reduces the time your accounting and billing departments spend on sending out invoices, but it also touches many other areas of a business. With a little help from robust recurring billing software, your business can focus on proactively retaining and attracting new customers, rather than reacting to dissatisfied ones churning out to your competitor.