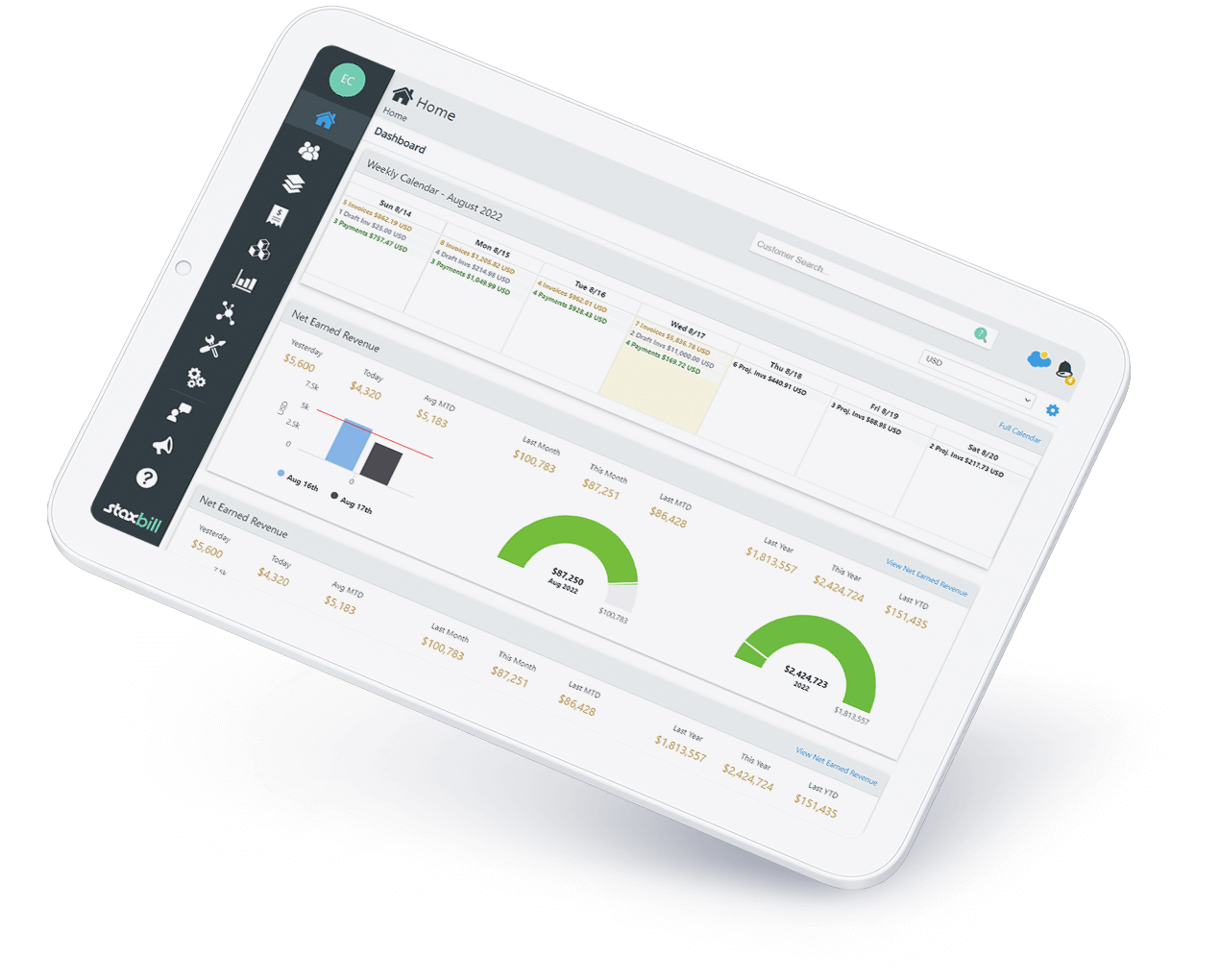

Stax Bill is automated subscription and payments with a personal touch. We help you automate the repetitive so you can stay focused on the big picture. Work more efficiently, recover more revenue, and collect on more invoices.

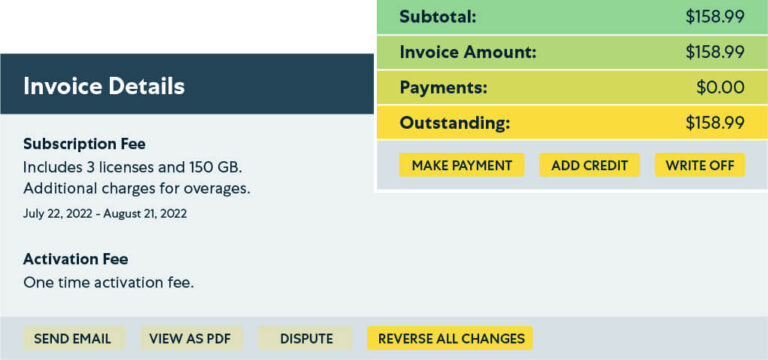

Simplify recurring billing & invoicing

How much time could you get back if your billing platform sent customer invoices on its own? We often see businesses redirecting a whopping 40 hours a month by putting their accounts receivable processes safely in the hands of automation. 🤯

The industry’s most agile product catalog

Need to quickly add a new product to your catalog? Easy peasy. Want to run a small-scale pricing experiment? You totally can. Sales asking to change the subscription price for just one account? Go for it—the customer’s always right.

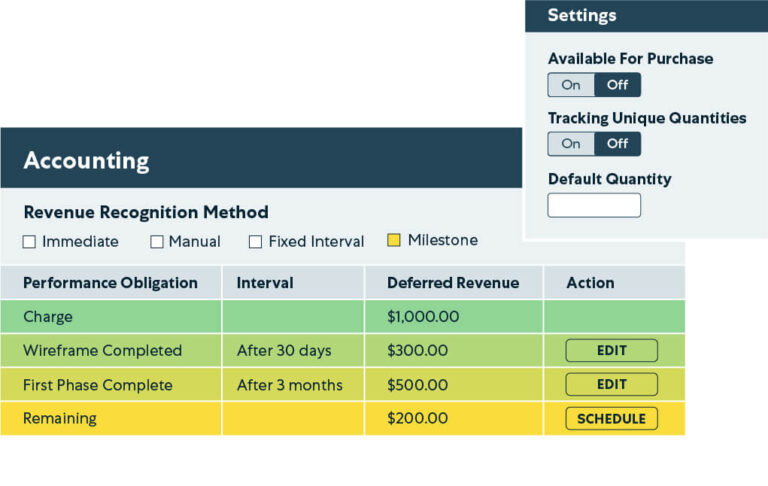

Automated, ASC 606-compliant revenue recognition

Whether you need to recognize revenue immediately, on a fixed interval schedule, or on a milestone basis, ASC 606 compliance is finally a “set it and forget it” kinda task.