Imagine there was a way to manage subscriptions for thousands of connected devices from one platform? What if you could make a range of changes and adjustments to each device plan in real-time and with nearly unbridled flexibility?

And imagine if you could automate the countless daily tasks related to billing and subscription management, saving your business hours of work and eliminating errors that lead to revenue leakage and customer churn?

If you’re handling the billing and subscription management of your telematics business with manual processes, this likely sounds like an Internet of Things (IoT) pipe dream.

But it’s a reality in the here and now; it’s also a business move that will pay for itself almost immediately.

With the telematics market expected to continue to grow annually, competition is about to get stiffer. Businesses in the telematics market that embrace the latest cloud-based billing technology will be set up for seamless scalability and will undoubtably earn a competitive advantage over those that don’t.

The following are five definitive ways real-time billing support with automated subscription billing can improve the bottom line for your telematics business.

1. Hyper-accurate recurring billing for telematics devices

Accurate monthly subscription billing eliminates revenue leakage. But day-to-day, there are a lot of changes and scenarios that occur with subscriptions. For example, they may need to be provisioned or migrated up or down to a new plan, or they may need to be cancelled or suspended for seasonal status. When these types of changes require manual human action, errors inevitably occur. And errors lead to lost revenue.

As the Director of Product for Stax Bill, I noticed this exact situation when my team was first integrating our subscription billing platform with a major telematics company.

I estimate there were a few errors being made each business day. We’re talking about $20 to $40 per connected device that the business wasn’t billing for, either partially or entirely. And who knows when the errors get corrected? It may be at the end of the month, it may be at the end of the year, or maybe when there’s a reconciliation. The only way to really manage and eliminate the revenue leakage is by automating billing.

Challenges surrounding subscription proration are another revenue leakage issue for many telematics businesses. For a lot of companies working with manual billing systems, when a customer subscribes mid-month, it’s easier to just start the subscription the following month.

While this simplifies the process on the accounting end, it also means forgoing revenue that could be collected on the days a subscription is active but not yet being billed for. Additionally, while your business might not be prorating for those initial days, you may be paying for product and data management on your end, creating additional revenue loss.

On a company with tens of thousands or millions in annual revenue, we estimate its savings—just on the proration—are about 1-3% of revenue per year.

Synchronizing the data from your connected devices with your billing system allows for automated proration, and it enables your business to reduce its revenue leakage.

2. Synchronized telematics data

Synchronizing your device data with a subscription billing system not only aids with hyper-accurate billing, but also it enables your telematics business to seamlessly manage the subscription plans of potentially thousands or hundreds of thousands of devices.

For example, synchronization makes it easy to manage contract start and end dates, and it ensures all your subscriptions remain up to date on pricing.

All other features for subscription come into play as well. For example, in the recurring billing world many subscriptions will have automatic uplifts built in. Real-time billing support can do this for your business automatically, whereas a company using manual processes would have to go in and update the pricing for each subscription manually. Because this can be difficult and time consuming, businesses often have an uplift lag.

It’s also very possible for some subscriptions to fall through the cracks and continue with outdated pricing for an extended period. Either situation equates to material revenue leakage for your business.

3. Catalog agility for improved monetization opportunities

When working with custom-built subscription billing systems, catalog agility—or lack thereof—can be a real challenge.

If marketing comes to you with an idea for a new plan—involving usage, for example—you’re going to have to get developers involved. That’s going to cost you time, money, and potentially lost revenue if your competitors are already going to market with the offer you’re still working on implementing.

Dynamic billing software enables your business to create any sort of plan or pricing you want to offer in real-time, and then roll it out within minutes. This level of flexible functionality creates opportunities to raise your average revenue per user (ARPU) with creative plans and pricing to suit your customers’ needs.

For example, if your business has a certain plan it offers to customer, it may want to create an add-on for an extra $2.99 per month as a value-add. You can add that on in your automated billing catalog and then give every customer in that plan immediate access to the new add on. The changes will automatically get pushed out to all those subscribers, who’ll be able to choose to tick that box all by themselves.

This business agility not only provides added value for your customers, but also it helps to raise your ARPU with very little effort from your team.

4. Collections and revenue recovery

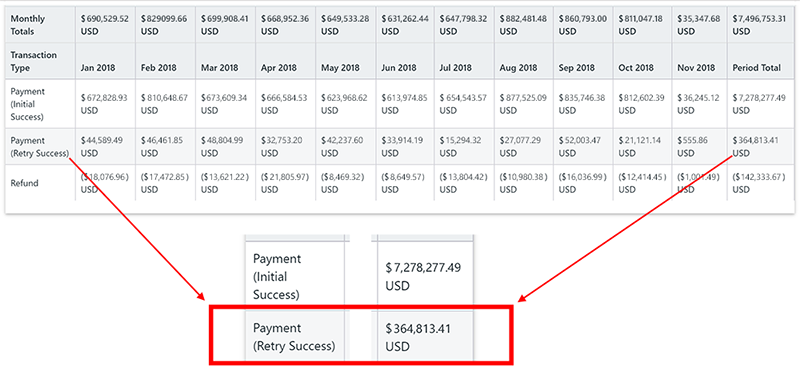

A lot of challenges related to recurring billing have to do with collecting on credit cards. Automated billing software can collect on cards for you through gateways, in addition to performing numerous other automated dunning management tasks.

For example, cloud-based billing software can be set up to automatically notify your customers when their cards are about to expire and offer easy options for updating their information—thus eliminating barriers to continuing the subscription.

Customers can also be automatically notified about failed payments, payment retries, successful payments, and more. Many different lifecycle management emails can be automatically deployed through these platforms with customization options to ensure on-brand look and messaging.

Automating the process of bringing in those collections reduces manual efforts which take your team away from other important tasks and eliminates customer churn and revenue leaks related to failed payments.

In fact, recouping these payments alone can often times offset the cost of a subscription billing system.

5. Enhanced marketing and sales capabilities to expand market

Finally, automated recurring billing software can be a boon for your business’s marketing and sales efforts and can ultimately help you grow recurring revenue.

Discounts, coupons, and promotional offers can be tailored to suit your goals. For example, perhaps you want to offer 300 uses of a coupon with a specific discount for a specific period. Forget about having to manually add and remove discounts.

Real-time billing support automates the process enabling you to attract and acquire new customers with less effort.

There’s so much change in devices and subscriptions it becomes an accounting nightmare when working with a legacy or manual billing system. Automated billing software elegantly synchronizes with data from telematics devices—including vehicle identification numbers (VIN) and serial numbers (ESN)—enabling the software to fully automate and streamline the billing process for rapid monetization.

All this saves time and helps reduce revenue leaks in the process, adding to your business’s bottom line, competitive advantage, and future scalability.